Much of the congestion occurring at intermodal rail terminals is ultimately related to factors beyond the control of the Class I railroads, and the railroads are doing all that they can to improve terminal throughput, assert the CEOs of U.S.-based Class I railroads to the Surface Transportation Board.

The board had asked the Class I railroads in July to explain what they were doing to address the congestion occurring at intermodal terminals. STB also asked the railroads to describe how and when they assess demurrage when containers aren’t being picked.

The railroads defended their responses, saying that although they do what they can to move containers out more quickly, the challenges facing other supply chain stakeholders — factors such as chassis and driver availability and labor shortages to support unloading at distribution centers — are affecting the railroads’ ability to move containers in and out of terminals in a timely fashion.

“Clearing our network will take some time, and it will require the cooperation of all stakeholders of the supply chain. Clearing the congestion and keeping the network fluid will be vital non-railroad improvements to the inadequate takeaway capacity at our ramps that is the root cause of the congestion,” said Union Pacific (NYSE: UNP) President and CEO Lance Fritz in a Thursday response to the board. “We are working hard to help our customers understand the problem and improve their operations.”

Fritz continued, “Shippers and receivers are responsible for their decisions to overextend their capacity in shipping and receiving, which congests the supply chain. This overextension is beyond our control.”

CSX (NASDAQ: CSX) President and CEO Jim Foote echoed similar sentiments in his Aug. 2 letter to the board.

“We work hard to optimize the movement of freight over our railroad and at the terminal, but we cannot be held accountable for the informed and calibrated decisions shippers are making to ship and that receivers are making as to their capability to receive. Nor can we be held responsible for the inefficiencies that exist in other parts of the supply chain,” Foote said.

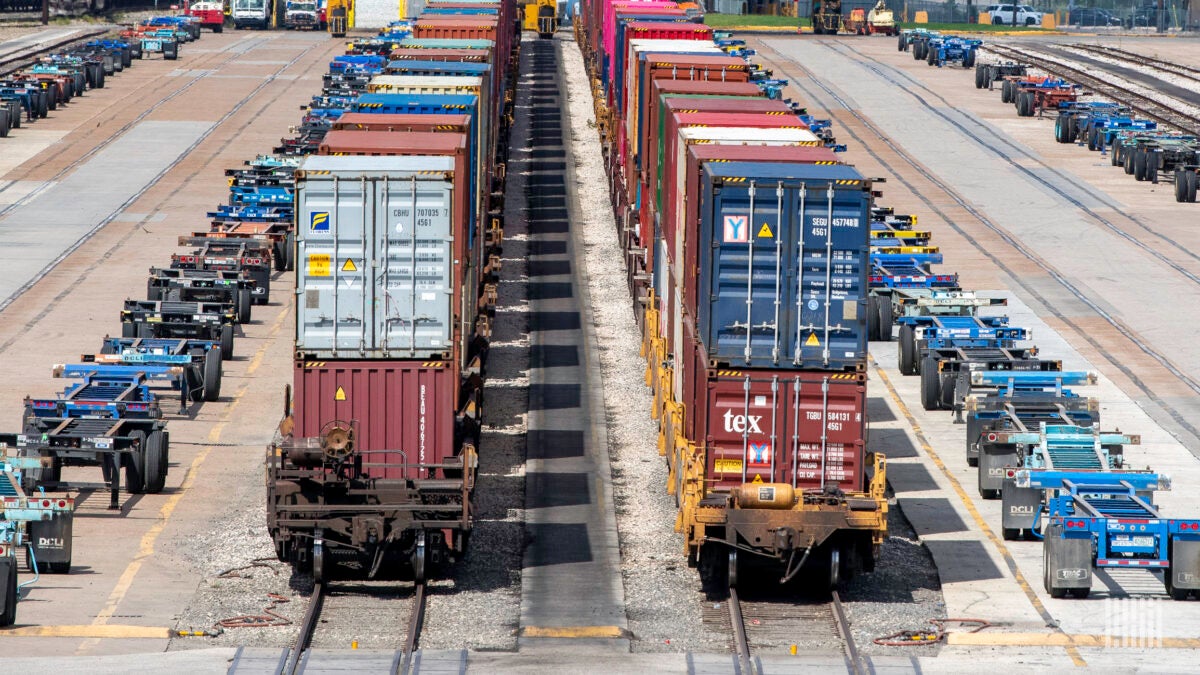

Rail intermodal terminals are not designed for, and are not physically capable of, long-term container storage for significant volume, Foote said. He explained that the throughput capacity of an intermodal terminal depends on the ability of receivers and steamship lines to maintain a relatively consistent flow of freight in and out of the terminal.

CSX has also sought to maintain open gates at its terminals and repositioned containers to off-site container yards when possible, Foote said. The railroad also communicates with East Coast ports daily to gauge current and projected flows, and it has engaged with customers on container dwell, he said.

BNSF President and CEO Katie Farmer said the backlogs at BNSF’s (NYSE: BRK.B) intermodal terminals can also be seen on other places on BNSF’s network, such as staging as many as 30 trains, holding around 7,500 containers, outside intermodal facilities because there isn’t enough space in BNSF’s hubs to get containers unloaded for pickup until the appropriate party coordinates the pickup of older containers for delivery to processing locations.

“We do believe that there is enough physical capacity present across the national supply chain to handle the current volumes,” Farmer said in her response to the board last Wednesday. She noted that BNSF has moved “significantly more” intermodal containers and trailers in 2021 than it did during the intermodal industry peak year of 2018.

“The amount of chassis, port and rail terminal capacity, rail equipment and employee resources is sufficient to handle the current volumes, but only if all parts of the supply chain do their part. Operating 24/7 in all parts of the supply chain, not just rail, would generate substantial capacity immediately,” Farmer continued.

Like the other Class I railroads, BNSF has been applying escalating storage fees to customers that take a long time to pick up their containers. The railroads say the fees are a way to encourage customers to move out their containers more quickly.

“As a railroad carrying containers between points where we are not the origination or the final destination of a load, BNSF has relatively few options to maintain the fluidity of our intermodal terminals if containers are not picked up by customers on a timely basis,” Farmer said. “Unless BNSF can utilize the few tools we have available to incentivize timely pickup – including storage charges when containers are left in our yards beyond free time – rail operations will degrade and ultimately come to a halt. … Our collective customers benefit as well when there is accountability across all users for effective management of resource use across the supply chain. The increased demand we face makes it imperative for us and our customers that we implement those reasonable accountability measures to support fluidity and maximum utility of rail capacity.”

The Class I railroads also said they would rather have smoother and more efficient terminal throughputs in the first place than assess demurrage.

“Consistent with KCS’ policy of preferring to work with customers to avoid storage, rather than collecting storage fees, we have also been flexible with the application of storage charges, where warranted,” said Kansas City Southern (NYSE: KSU) President and CEO Pat Ottensmeyer in an Aug. 3 response to the board.

On assessing storage fees, Norfolk Southern (NYSE: NSC) President and CEO Jim Squires said in his Friday response: “The purpose of Norfolk Southern’s storage fee policies is to encourage prompt retrieval of shipments once they have arrived at one of our intermodal facilities. Our terminals are not designed or intended for extended storage or warehousing. Delays in pulling containers from our terminals results in congestion, which impacts the fluidity of our operations and the level of service we are able to provide to our intermodal customers.”

To ease congestion at its international intermodal terminals, NS has taken measures such as metering traffic at origin to keep the flow of containers to inland destination terminals consistent with the ability of the drayage and warehouse communities to pull from those terminals, increasing the flow of inbound containers as “outgate” capacity improves, Squires said.

Other modifications have included making changes and upgrades to NS’ Chicago terminal to increased stacked container capacity by 60% and lift capacity by 40%; working with the Western railroads to create steel-wheel interchanges in Chicago, alleviating pressure on the drayage community for cross-town interchanges; and developing an incentive program “that rewards customers who achieve at least 50% ‘dual missions’ (that is, bringing one container out for every container brought in) at our Chicago and Kansas City terminals, which will encourage greater efficiency and help relieve pressure on driver availability and chassis supply,” Squires said.

Midwest rail congestion affecting West Coast container flows: Maersk

The responses by the Class I railroads to STB come as ocean carrier Maersk said Friday that rail congestion in the Midwest is affecting container flows to and from U.S. West Coast ports.

In a Friday customer advisory, Maersk said the congestion in hubs such as Chicago and Memphis is causing “some major disruptions,” with rail import dwell at Long Beach extending beyond eight days on average because fewer trips are heading back to the West Coast from the Midwest hubs.

The rail congestion is limiting customers’ ability to return empty containers, compounding a broader container shortage, Maersk said.

Subscribe to FreightWaves’ e-newsletters and get the latest insights on freight right in your inbox.

Click here for more FreightWaves articles by Joanna Marsh.

Don Starr

Shortage of train crews too.

Nobody wants to work for the RRs no more.

Dave

The problem at Norfolk Southern is that the trains are being built so large…some nearly 3 miles long, that the access roads to and within the intermodal yards are blocked by the gigantic trains that are being built. The trucks can’t get in or out and yet the railroad blames the trucks.

Joe

PSR

Mark Snyder

In order to solve the rail problem you have to solve the labor problem. The shortage of labor prevents movement of containers because there are fewer drivers. It causes delays in unloading containers, which reduces the empty and chassis pools, when warehouses cannot find workers to manage the freight. It creates bottlenecks at the ports, who can’t work as efficiently. And the labor problem exists not because we don’t have enough people in the US, or can’t teach people how to drive a truck, but because the current administration has not taken action to incentivize people to return to the workplace. Right now, a family in California can make about ~$60k per year by not working, and receiving expanded unemployment. With fewer places to send children during the workday, and little reason to go out and earn a living, we are encouraging a lifestyle that relies on government hand outs. If you want to eat, you have to work, and we need to start addressing the narrowed workforce aggressively. Most of these jobs are, by nature, socially distanced jobs too. This is a low COVID risk job, compared to working in store, a restaurant or a school. Lets get American back to work and then we will start moving cargo through the system. (And just for the record, I am a Democrat. This is not a political statement.)

Dark Lord Gaseous the Bold

Port of Houston is an example of the hold up. I’m an owner operator truck driver who on multiple occasions has tried to get freight out of the ports. Number one issue ports wanting to charge more for freight sitting there in port(dimurage) they also want an appointment set up for a different pick up time after I have informed brokers of the additional fee demand by the port. They will not tell you about the appointment until you pay the fee then you pay more delay fee waiting for the port to let you have the freight(load it onto a truck). Therefore it gets to a point where it’s cheaper to abandon the freight and order new.. Yes it is a port issue not trucking I can’t get the port to load it onto the truck.

Cutback4ever

Saying don’t blame the class 1’s is like saying don’t blame Manson for the Tate murders.

The class 1’s in their pursuit of eliminating as many jobs as possible, furloughed thousands of workers unnecessarily and worked the remaining ones half to death and reduced capacity and ability to haul immensely while driving up shipping costs to nearly double record rates, while suing to eliminate conductor/brakeman positions and refusing to negotiate a contract without the elimination of those jobs, are now claiming they cannot get furloughed employees to return or find new hires.

There’s more long term over 10 year employees quiting the class 1’s now than ever and more everyday because they’re working their people into the ground unnecessarily while refusing any pay increase or security as they hijack the US economy and drive inflation/shipping costs higher every day, all the while with their hand out for billions in government funding. If the workers cannot strike because it’s a matter of national security, than the railroads should have to meet their obligation to carry, or be nationalized.

The class 1’s and psr are at fault and the safe freight act, H.R. 1748 along with a train length restriction like the one Sen. Lynn Walz of Neb. has proposed needs to be signed into law, before any federal funding should be released to any of the class 1’s, to ensure public safety and road crossings from being blocked for several miles and protect jobs.

Dave

The rail companies do not supply accurate or timely information on where containers are at in the system. I had some occasions when we were informed 1 day that can has not loaded on rail and next day it was at our ramp with LFD of the day before. There has been no consistency in time vessels have unloaded until cans are on rail. Ranges from 7 days to as long as 8 weeks. There is no human interaction in the process and when you do get a person, they are so overloaded with request/complaints, that you can feel their pain. The system is being manipulated to line pockets of shippers and taking from the customer and ultimately the consumer. I have never seen anything so poorly serviced with the ability to raise prices to historic rates. We throw the gas stations owner in jail when they charge excess rates per gallon of gas during natural disasters, but during the worst pandemic in a hundred years, we allow 10 companies to rob us blind! There is no doubt that collusion is occurring as no other company has even tried to keep prices stable a year and half after reopening now. Our industry has raised prices 30% in the last year on freight cost alone. if something does not change, they will push economy into recession quickly. Then they will beg for government assistance. Hire some people, ask for fair compensation for services provided and fix the problem! You’ve had enough time.

Mike

How come during the 80’s and 90’s and early 2000’s before somebody’s son in law or nephew, the intermodel yards before being consolidated into 1 big yard was able to keep it flowing. They thought they would save money, cut jobs, as long as it wasn’t theirs. How do I know, worked for the RR since 1974, started as Bateman worked up to train dispatcher.