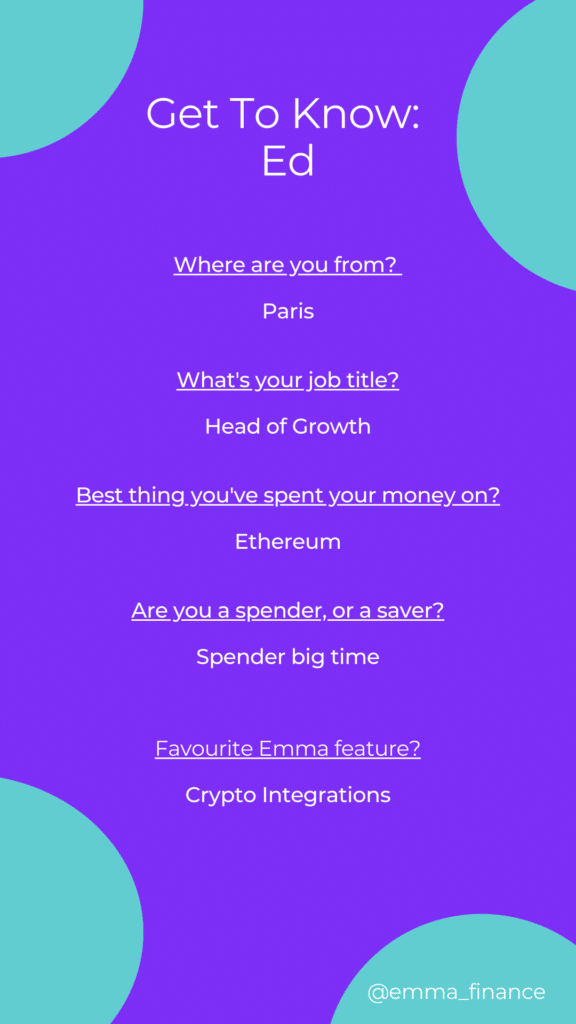

Next up in our series of team interviews, we’re speaking to Ed – Head of Growth at Emma. Find out what Ed gets up to each day, as well as finding out what his favourite thing about Emma is!

Hi Ed! Can you tell us who you are, and what you do at Emma?

Hi, my name is Ed and I come from Paris.

I’ve been helping scale D2C tech startups in London for the past few years and I’m involved with all things growth here at Emma, from product to our acquisition/retention/monetization pipeline.

Basically my job is to get more people to try Emma and become active members of our community.

What’s the best thing about your job?

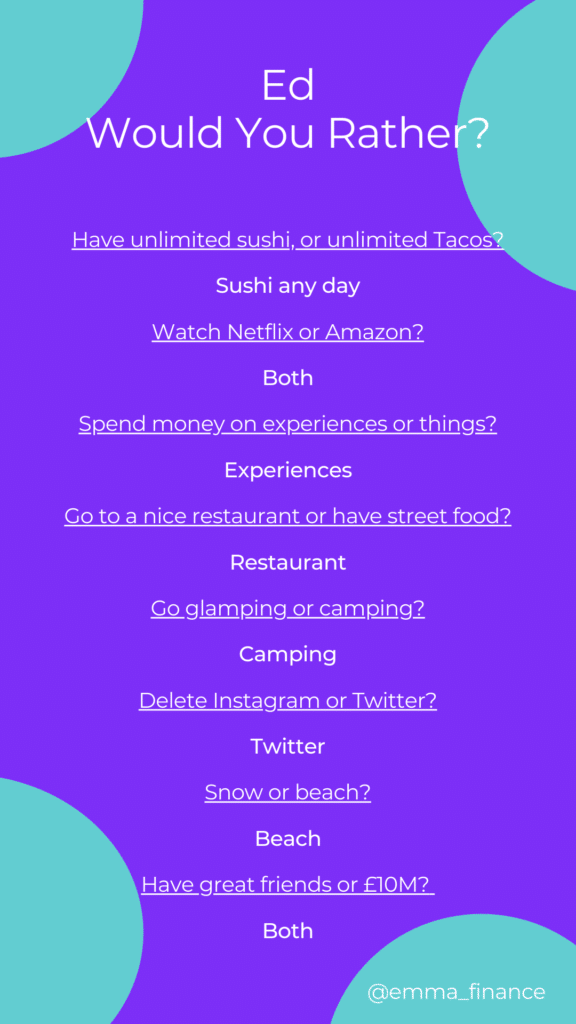

Doing different things all the time.

You can catch me crunching numbers & adjusting forecasts, playing with Instagram ads on Photoshop, testing a new screen for our referral programme & analysing conversion funnels, all in the same day 🙂

If you could only use 5 words to describe Emma, what would they be?

‘Take Control Of Your Finances’

What is it about Emma that you think has made it so successful?

People have been so frustrated with online banking experiences for a while and more and more people have opened accounts with digital first banks like Monzo or Revolut, or even started saving using a robo advisor for instance.

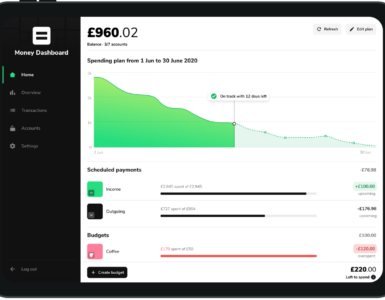

The problem with this trend is that your financial footprint becomes more complex, meaning you need multiple apps to stay on top and it’s getting even harder to get the full picture or identify area for improvement.

I think we are filling that gap by making it super easy and fun for people to get a bird’s eye view of their money and see how they could save money in just a few steps.

Do you have a favourite feature within Emma?

Most definitely: the cryptocurrency integrations!

I haven’t found any other money management app that offers this yet apart from Emma.

It’s amazing that I can aggregate all assets from my Coinbase & Binance exchange accounts as well as my Bitcoin & Ethereum addresses.

What do you enjoy spending your money on?

Travelling, gigs & good food (mostly good food this year)

If someone gave you £1,000, would you save it, spend it, or invest it?

Invest it in crypto (Ethereum or Polkadot), retire next year?

If you had to pick one emoji to describe your finances, what would you pick?

Before Emma: 🙈

After Emma: 📈

We hope you enjoyed this interview with Ed from the Emma team! If you want to continue getting to know the Emma Finance team, make sure you join the Emma Community. Or, reach out to us on Facebook, Instagram, or Twitter!

And if you want to learn more about how to use the Emma app then click through to “Eight Reasons You Need Emma Pro” or “How To Use Emma“.

Emma is a money management app that connects all your bank accounts to track your monthly spending and subscriptions. Emma will help you visualise and take control of your finances. Make sure you aren’t overspending, and show you practical steps to start budgeting effectively.

Add comment