IMARC made the whole process easy. Everyone I spoke with via email was polite, easy to deal with, kept their promises regarding delivery timelines and were solutions focused. From my first contact, I was grateful for the professionalism shown by the whole IMARC team. I recommend IMARC to all that need timely, affordable information and advice. My experience with IMARC was excellent and I can not fault it.

Read More

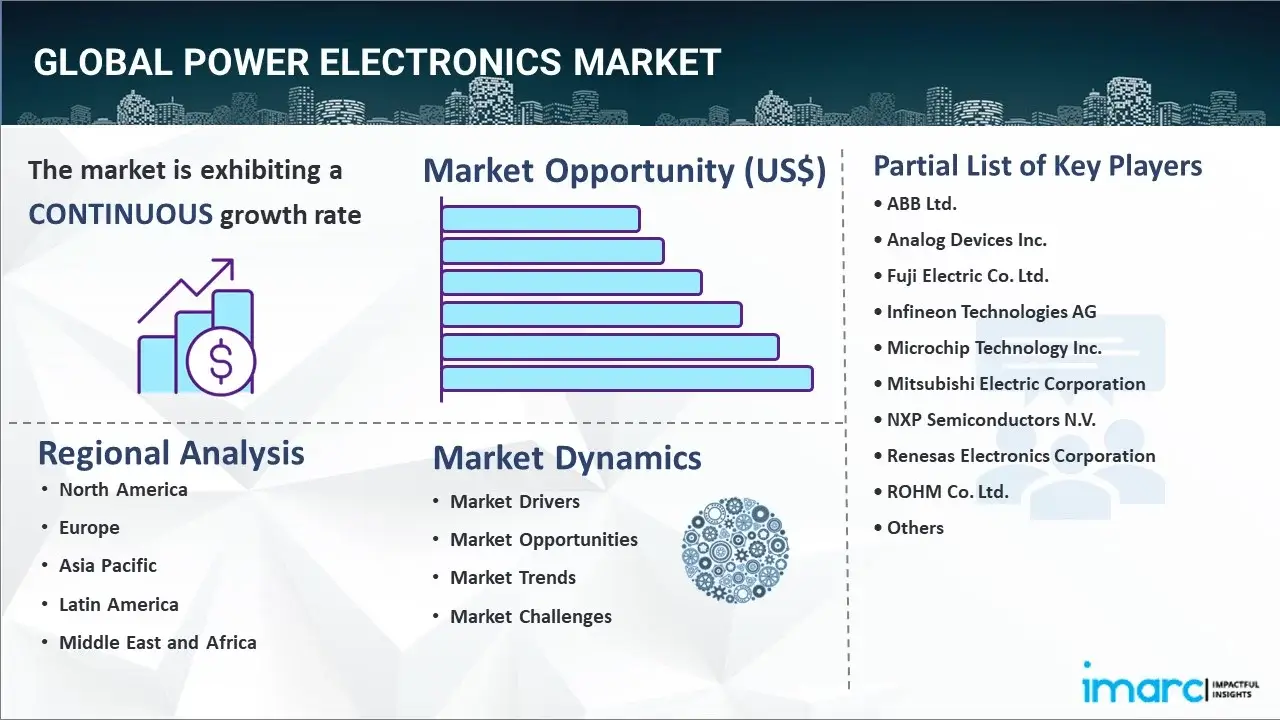

Power Electronics Market Report by Device (Power Discrete, Power Modules, Power ICs), Material (Silicon, Sapphire, Silicon Carbide, Gallium Nitride, and Others), Application (Power Management, UPS, Renewable, and Others), Voltage (Low Voltage, Medium Voltage, High Voltage), End Use Industry (Automotive, Military and Aerospace, Energy and Power, IT and Telecommunication, Consumer Electronics, and Others), and Region 2024-2032

Power Electronics Market Size:

The global power electronics market size reached US$ 31.3 Billion in 2023. Looking forward, IMARC Group expects the market to reach US$ 50.4 Billion by 2032, exhibiting a growth rate (CAGR) of 5.3% during 2024-2032. The market is experiencing robust growth, driven by the increasing demand for energy-efficient devices, the expansion of the renewable energy sector, rapid advancements in automotive electronics, the proliferation of consumer electronics, and the imposition of supportive government regulations.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2023

|

|

Forecast Years

|

2024-2032

|

|

Historical Years

|

2018-2023

|

|

Market Size in 2023

|

US$ 31.3 Billion |

|

Market Forecast in 2032

|

US$ 50.4 Billion |

| Market Growth Rate 2024-2032 | 5.3% |

Power Electronics Market Analysis:

- Major Market Drivers: The primary reasons encompass the continuous transition towards energy efficiency in the automotive, consumer electronics, and industrial domains, swift growth in the renewable energy industry, and increasing progressions in the automotive sector.

- Key Market Trends: Recent developments in the power electronics market analysis include the continued adoption of silicon carbide (SiC) and gallium nitride (GaN) technologies as a result of their improved efficiency, performance, and thermal management.

- Geographical Trends: The market is led by the Asia Pacific region due to its strong industrial growth, manufacturing capabilities, and substantial investments in renewable energy and electrification of automobiles. Other regions are also expanding because of the increased emphasis on innovation and the use of power electronics solutions in industrial, automotive, and renewable energy applications.

- Competitive Landscape: Some of the major market players in the power electronics industry include ABB Ltd., Analog Devices Inc., Fuji Electric Co. Ltd., Infineon Technologies AG, Microchip Technology Inc., Mitsubishi Electric Corporation, NXP Semiconductors N.V., Renesas Electronics Corporation, ROHM Co. Ltd., STMicroelectronics, Texas Instruments Incorporated, Toshiba Corporation and Vishay Intertechnology Inc., among many others.

- Challenges and Opportunities: As per the power electronics market outlook, the industry is confronted with various challenges, including controlling heat dissipation and attaining high power density in small dimensions. Nevertheless, there are prospects for growth due to continuous innovation in cooling methods and component designs, which aim to improve the dependability and efficiency of power electronic systems.

Power Electronics Market Trends:

Increasing Demand for Energy-Efficient Devices

One of the main factors propelling the growth of the power electronics market is the increased demand for energy efficiency. Global energy consumption is estimated to be 580 million terajoules annually and is projected to rise to 740 million terajoules by 2040. Also, compared to 2020 levels, the United States' energy-related carbon dioxide (CO2) emissions grew by 296 million metric tons (MMmt) or 6% in 2021. The adoption of power electronics by governments and organizations globally to lower energy usage and carbon footprints is the answer, according to researchers analyzing the question is power electronics are in demand. Power electronics will be used more frequently, for example, as India's adoption of clean energy technology expands the market to over $40 billion annually by 2040 for solar photovoltaic (PV), wind turbine, and lithium-ion battery equipment. This indicates that 1 in every 7 dollars spent on these equipment’s in 2040 will be in India. Also, India's clean energy workforce will grow by 1 million over the next ten years.

Growth in Renewable Energy Sector

The renewable energy sector's expansion is another significant factor fueling the power electronics market demand. As the world increasingly shifts to renewable sources to meet its escalating energy needs, the demand for power electronics that efficiently convert and manage the electricity generated from these sources grows. According to IMARC Group, the renewable energy sector is anticipated to reach US$ 1,733.0 Billion by 2032, with a growth rate of 7.65%. Regionally, the share of renewable energy in the European Union (EU) increased to 23% in 2022. The gross final consumption of renewables grew by 5 million tonnes of oil equivalent (Mtoe) between 2021 and 2022, driven by an increase in solar power generation by 28% and wind power by 6.6%. Also, the region witnessed a reduction in the use of non-renewables by 2.9%. Power electronics are essential for the optimal operation of renewable energy systems, from controlling the flow and direction of power in solar inverters to adjusting the output of wind turbines.

Advancements in Automotive Electronics

The power electronics market revenue is significantly influenced by the automobile industry's shift towards electric and hybrid vehicles. It is projected that the market for electric vehicles (EVs) will reach 381.3 million units by 2032, growing at a rate of 34% per year. By 2035, it is predicted that EV sales in China will increase from less than a million in 2019 to over 20 million annually. The yearly production of batteries is expected to expand by a minimum of thirty times, which will raise the demand for power electronics to manage the power transfer between the battery, motor, and other electrical systems. These positive trends are driving up demand for power electronics parts, including chargers, inverters, and converters.

Power Electronics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the global, regional, and country levels for 2024-2032. Our report has categorized the market based on device, material, application, voltage, and end use industry.

Breakup by Device:

- Power Discrete

- Diode

- Transistors

- Thyristor

- Power Modules

- Intelligent Power Module

- Power Integrated Module

- Power ICs

- Power Management Integrated Circuit

- Application-Specific Integrated Circuit

Power modules accounts for the majority of the market share

The report has provided a detailed breakup and analysis of the market based on the device. This includes power discrete (diode, transistors, and thyristor), power modules (intelligent power module and power integrated module), and power ICs (power management integrated circuit and application-specific integrated circuit). According to the report, power modules represented the largest segment.

According to the power electronics market trends, power modules dominated the market share, attributed to their use in a wide array of applications, such as renewable energy systems and automotive electronics. They integrate various power electronic components into a single unit, which is essential for efficient power conversion and management in these applications. Moreover, power modules’ ability to handle high power densities and improve system reliability while minimizing physical footprint is boosting the market growth. Besides this, the heightened demand for electric vehicles (EVs), coupled with the ongoing shift towards renewable energy sources, is enhancing the power modules' market value.

Breakup by Material:

- Silicon

- Sapphire

- Silicon Carbide

- Gallium Nitride

- Others

Silicon carbide holds the largest share of the industry

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes silicon, sapphire, silicon carbide, gallium nitride, and others. According to the report, silicon carbide accounted for the largest market share.

Based on the power electronics market research, silicon carbide (SiC) emerged as the predominant segment, due to its superior properties that cater to the demand for more efficient and high-performance power electronic devices. It is known for its exceptional thermal conductivity, high-temperature resilience, and greater energy efficiency compared to traditional silicon-based components. Moreover, the increasing utilization of silicon carbide in high-power applications across various industries, including automotive, renewable energy, and consumer electronics, is catalyzing the market growth. Furthermore, the heightened adoption of SiC-based power electronics in electric vehicles (EVs) and renewable energy systems to improve range and performance is supporting the market growth.

Breakup by Application:

- Power Management

- UPS

- Renewable

- Others

Renewable represents the leading market segment

The report has provided a detailed breakup and analysis of the market based on the application. This includes power management, UPS, renewable, and others. According to the report, renewable represented the largest segment.

According to the research based on what is the power electronics market forecast, the renewable energy sector constituted for the largest share, owing to the rising shift towards sustainable energy solutions, with an increasing focus on solar, wind, and other renewable energy sources. Power electronics are pivotal in the renewable sector to enable the efficient conversion, conditioning, and management of electricity generated from renewable sources. Moreover, the increasing demand for advanced power electronics in the renewable sector, fueled by technological advancements, supportive government policies, and growing environmental awareness, is bolstering the power electronics market share.

Breakup by Voltage:

- Low Voltage

- Medium Voltage

- High Voltage

Medium voltage exhibits a clear dominance in the market

A detailed breakup and analysis of the market based on the voltage have also been provided in the report. This includes low voltage, medium voltage, and high voltage. According to the report, medium voltage accounted for the largest market share.

Based on the power electronics market forecast, the medium voltage segment represented the largest share, highlighting its use in various applications, such as industrial motor drives and renewable energy systems. Medium voltage power electronics are essential for the efficient control and conversion of electrical power in applications that require voltages typically ranging from 600V to several kilovolts. Moreover, the rising demand for energy efficiency and high power density in sectors such as industrial automation, electric vehicles (EVs), and renewable energy generation utilize medium voltage solutions for optimizing performance and ensuring reliability. Additionally, their integration in smart grids and the electrification of transportation, owing to their versatility and essential role in facilitating the transition towards more sustainable and efficient electrical power systems, is catalyzing the market growth.

Breakup by End Use Industry:

- Automotive

- Military and Aerospace

- Energy and Power

- IT and Telecommunication

- Consumer Electronics

- Others

Automotive represent the leading market segment

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes automotive, military and aerospace, energy and power, IT and telecommunication, consumer electronics, and others. According to the report, automotive represented the largest segment.

According to the power electronics market analysis, the automotive sector emerged as the largest segment due to the rapid evolution towards electrification in transportation. The rising shift towards electric vehicles (EVs), including pure electric, hybrid, and plug-in hybrid vehicles (HVs), is fueling the market growth. Power electronics are the backbone of EVs as they manage battery charging, power conversion, and motor control, thus ensuring efficiency, performance, and range optimization. Along with this, the rising demand for enhanced vehicle capabilities with advanced features, like fast charging and improved energy management systems, is boosting the market growth.

Breakup by Region:

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- India

- South Korea

- Australia

- Indonesia

- Others

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Russia

- Others

- Latin America

- Brazil

- Mexico

- Others

- Middle East and Africa

Asia Pacific leads the market, accounting for the largest power electronics market share

The report has also provided a comprehensive analysis of all the major regional markets, which include North America (the United States and Canada); Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others); Europe (Germany, France, the United Kingdom, Italy, Spain, Russia, and others); Latin America (Brazil, Mexico, and others); and the Middle East and Africa. According to the report, Asia Pacific represents the largest regional market for power electronics.

Based on the power electronics market outlook, Asia Pacific represented the largest market share, attributed to the region's significant industrial growth, technological advancements, and the swift expansion of key end-use sectors, such as automotive, consumer electronics, and renewable energy. Moreover, the region comprises rapidly developing economies, like China, India, and South Korea, for manufacturing and technology innovation. Moreover, the ongoing shift towards electrification of transport, a booming consumer electronics sector, and substantial investments in renewable energy infrastructure are favoring the market growth. For example, India witnessed the highest year-on-year (YoY) growth in renewable energy additions of 9.83% in 2022. The installed solar energy capacity increased by 30 times in the last 9 years and accounts for 75.57 GW as of Feb 2024. Moreover, the country's solar energy potential is also estimated to hit 748 GWp, according to the National Institute of Solar Energy (NISE).

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have also been provided. Some of the major market players in the power electronics industry include ABB Ltd., Analog Devices Inc., Fuji Electric Co. Ltd., Infineon Technologies AG, Microchip Technology Inc., Mitsubishi Electric Corporation, NXP Semiconductors N.V., Renesas Electronics Corporation, ROHM Co. Ltd., STMicroelectronics, Texas Instruments Incorporated, Toshiba Corporation, Vishay Intertechnology Inc, etc.

- According to studies that researched about what is the trend in power electronics, it has been found that major players in the market are engaged in research and development (R&D) to introduce innovative and more efficient solutions, particularly focusing on materials like silicon carbide (SiC) and gallium nitride (GaN) to enhance the boundaries of power density, efficiency, and thermal performance. They are expanding their product portfolios and entering into strategic partnerships and acquisitions to enhance their technological capabilities and market reach. For instance, In August 2023, Infineon Technologies AG collaborated with Infypower to provide the industry-leading 1200 V CoolSiC MOSFET power semiconductor devices for improving the efficiency of electric vehicle charging stations. Moreover, companies are investing in expanding their manufacturing capabilities to meet the growing demand from the renewable energy sector and consumer electronics market. Besides this, they are adopting environmentally friendly practices in their operations and product designs.

Power Electronics Market News:

- In June 2021, STMicroelectronics announced the launch of STi2GaN, a smart power electronic in its ST Intelligent and Integrated Gallium Nitride (GaN) solutions family. The device employs bond-wire-free packaging technology for reliability, durability, and performance. It also utilizes integrated gallium nitride (GaN) high power density to provide a variety of efficient devices to the automobile industry.

- In November 2023, Mitsubishi Electric Corporation announced a strategic partnership with Nexperia B.V. to develop silicon carbide (SiC) power semiconductors for the power electronics industry. Mitsubishi Electric will leverage its wide-bandgap semiconductor technologies to develop and supply SiC MOSFET chips that Nexperia will utilize to create SiC discrete devices.

- In May 2023, Vishay Intertechnology, Inc. released 17 new third-generation 650V silicon carbide Schottky diodes (SiC). They feature a merged pin Schottky (MPS) design which combines high surge current capability with low forward voltage drop, capacitive charging, and reverse leakage current.

Power Electronics Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2023 |

| Historical Period | 2018-2023 |

| Forecast Period | 2024-2032 |

| Units | US$ Billion |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Devices Covered |

|

| Materials Covered | Silicon, Sapphire, Silicon Carbide, Gallium Nitride, Others |

| Applications Covered | Power Management, UPS, Renewable, Others |

| Voltages Covered | Low Voltage, Medium Voltage, High Voltage |

| End Use Industries Covered | Automotive, Military and Aerospace, Energy and Power, IT and Telecommunication, Consumer Electronics, Others |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East and Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, Russia, China, Japan, India, South Korea, Australia, Indonesia, Brazil, Mexico |

| Companies Covered | ABB Ltd., Analog Devices Inc., Fuji Electric Co. Ltd., Infineon Technologies AG, Microchip Technology Inc., Mitsubishi Electric Corporation, NXP Semiconductors N.V., Renesas Electronics Corporation, ROHM Co. Ltd., STMicroelectronics, Texas Instruments Incorporated, Toshiba Corporation, Vishay Intertechnology Inc., etc. (Please note that this is only a partial list of the key players, and the complete list is provided in the report.) |

| Customization Scope | 10% Free Customization |

| Report Price and Purchase Option | Single User License: US$ 3899 Five User License: US$ 4899 Corporate License: US$ 5899 |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the global power electronics market performed so far, and how will it perform in the coming years?

- What are the drivers, restraints, and opportunities in the global power electronics market?

- What is the impact of each driver, restraint, and opportunity on the global power electronics market?

- What are the key regional markets?

- Which countries represent the most attractive power electronics market?

- What is the breakup of the market based on the device?

- Which is the most attractive device in the power electronics market?

- What is the breakup of the market based on the material?

- Which is the most attractive material in the power electronics market?

- What is the breakup of the market based on the application?

- Which is the most attractive application in the power electronics market?

- What is the breakup of the market based on voltage?

- Which is the most attractive voltage in the power electronics market?

- What is the breakup of the market based on the end use industry?

- Which is the most attractive end use industry in the power electronics market?

- What is the competitive structure of the market?

- Who are the key players/companies in the global power electronics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the power electronics market from 2018-2032.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the global power electronics market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the power electronics industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Purchase options

Benefits of Customization

Personalize this research

Triangulate with your data

Get data as per your format and definition

Gain a deeper dive into a specific application, geography, customer, or competitor

Any level of personalization

Get in Touch With Us

UNITED STATES

Phone: +1-631-791-1145

INDIA

Phone: +91-120-433-0800

UNITED KINGDOM

Phone: +44-753-713-2163

Email: sales@imarcgroup.com

Inquire Before Buying

Inquire Before Buying Speak to an Analyst

Speak to an Analyst  Request Brochure

Request Brochure  Request Customization

Request Customization

.webp)

.webp)