Table of Contents

ToggleAs digital payments become more prevalent, businesses are looking for fast, secure, and reliable ways to send and receive money. Cash apps are a convenient solution for businesses, as they offer a variety of features that make it easy to transfer funds between accounts.

Digital platforms called mobile payment applications let customers use their smartphones to pay businesses. Customers can transfer and receive money using these apps safely and easily without having to use cash. Numerous of these apps also include extra features like loyalty programs, savings, and incentives, which increase their allure for small company owners.

Apps for mobile payments employ Near Field Communication (NFC) technology or the camera on your smartphone to swiftly and securely transfer money. Customers launch the app on their phone and select the payment method they want to use to use a mobile payment app. They might have to use an app to enter their payment information or scan a QR code the company has provided. Both parties are informed after the transaction is complete that the payment was successful.

Here are a few of the main advantages:

Convenience: Cash apps are incredibly convenient for businesses. They allow for quick and easy transfers between accounts without the need for cash or checks. This means that businesses can send and receive payments on the go, from anywhere at any time.

Speed: Cash apps offer fast transfers, often completing transactions within minutes. This means that businesses can receive payments quickly, which is especially useful for freelancers or small business owners who need to get paid quickly to keep their cash flow going.

Security: Cash apps use encryption technology to keep transactions secure, which means that businesses can trust that their financial information is protected. This is important for businesses that handle sensitive financial data.

Cost-Effective: Many cash apps offer free transfers between accounts, which can save businesses money on transaction fees. This is especially useful for small businesses or freelancers who may not have a large budget for transaction fees.

International Transactions: Many cash apps offer the ability to send and receive payments in multiple currencies, which is great for businesses that work with international clients. This can save businesses money on currency conversion fees and make international transactions much simpler.

Integration with other payment systems: Some cash apps, such as Square Cash, also offer the ability to process credit card payments. This means that businesses can use the same app to manage all their payment processing needs, making it a one-stop-shop for all payment-related activities.

Overall, using cash apps to send and receive money can offer businesses many benefits, including convenience, speed, security, cost-effectiveness, and the ability to manage all payment processing needs in one place.

PayPal

PayPal is one of the most popular cash apps, and for good reason. It’s secure, easy to use, and widely accepted. Businesses can send and receive money with PayPal, and there are no transaction fees for transfers between PayPal accounts.

Venmo

Venmo is a peer-to-peer cash app that’s great for small businesses. It’s free to use, and businesses can easily send and receive money from other Venmo users. Transactions can be completed quickly, and there are no fees for transferring funds between Venmo accounts.

Square Cash

Square Cash is another popular cash app that’s great for businesses. It’s easy to use and offers fast, secure transfers. Businesses can also use Square Cash to process credit card payments, making it a one-stop-shop for all your payment needs.

Zelle

Zelle is a fast and easy way to send and receive money between bank accounts. It’s free to use, and transfers are usually completed within minutes. Businesses can also use Zelle to request payments from clients, making it a great option for freelancers and small business owners.

Google Pay

Google Pay is a secure and easy-to-use cash app that’s great for businesses. It offers fast, free transfers between accounts, and businesses can also use it to process payments through Google Wallet. Plus, it’s widely accepted, making it a great choice for businesses that need to send and receive money from a variety of sources.

Apple Pay

Apple Pay is a popular cash app that’s great for businesses. It’s secure, easy to use, and widely accepted. Businesses can send and receive money with Apple Pay, and there are no transaction fees for transfers between Apple Pay accounts.

Payoneer

Payoneer is a global payment platform that’s great for businesses that work with international clients. It offers fast, secure transfers, and businesses can receive payments in multiple currencies. Plus, Payoneer offers competitive exchange rates, making it a cost-effective option for businesses that need to convert currencies.

TransferWise

TransferWise is another great cash app for businesses that work with international clients. It offers fast, secure transfers, and businesses can receive payments in multiple currencies. Plus, TransferWise offers competitive exchange rates, making it a cost-effective option for businesses that need to convert currencies.

Popmoney

Popmoney is a cash app that’s great for businesses that need to send and receive payments from individuals. It offers fast, secure transfers, and businesses can send payment requests to clients via email or text. Plus, Popmoney is widely accepted, making it a great choice for businesses that need to transfer funds to a variety of sources.

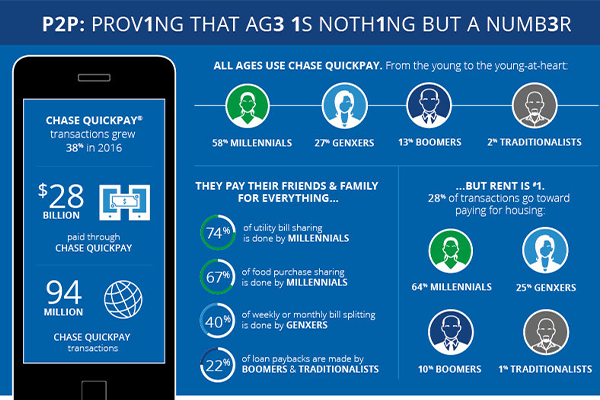

Chase QuickPay

Chase QuickPay: Chase QuickPay is a cash app that’s great for businesses that have a Chase bank account. It offers fast, secure transfers, and businesses can send and receive money from other Chase QuickPay users. Plus, transfers between accounts are free, making it a cost-effective option for businesses that need to transfer funds between Chase accounts.

Conclusion About Top 10 Cash Apps for Businesses

In conclusion, cash apps are a convenient way for businesses to send and receive money. With so many great options available, businesses can choose the cash app that best meets their needs. Whether you’re looking for a secure, easy-to-use cash app or one that’s great for international transactions, there’s a cash app out there that’s right for your business.

Product Name: Top 10 Cash Apps for Businesses: Fast, Secure, and Convenient Ways to Send and Receive Money

All orders are protected by SSL encryption – the highest industry standard for online security from trusted vendors.