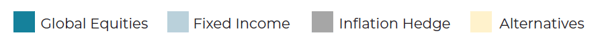

If the markets are in a “business as usual” mode, then your portfolio will look similar to other investment strategies you may be familiar with.

But, when unique market events arise, your portfolio will automatically adjust.

This adaptive approach gives Blueprint the flexibility to manage risk for you, regardless of the market environment.

![]() Asset class diversification

Asset class diversification

You gain exposure across several major global asset classes in a single investment vehicle

![]() A rules-based process

A rules-based process

Your capital can be protected during times of prolonged market volatility because the repeatable process for making all portfolio decisions leaves no room for emotional decision-making during times of euphoria or fear

![]() A focus on managing downside risk

A focus on managing downside risk

Your portfolio is constructed in a way that aims to preserve your investment during market downtrends (like the “coronacrash” of March 2020), which can be particularly important if you’re around retirement age

![]() Automatic adjustments in response to market changes

Automatic adjustments in response to market changes

Your portfolio naturally adapts when there are uptrends/downtrends in an asset class, interest rate change, volatility arises, and inflation/deflation occurs

Please reach out for further information about Blueprint’s approach to risk management.

For more information, see Form ADV Part 2A & Form CSR (Part 3) on the Blueprint website.