AI activity in UK businesses: Executive Summary

Published 12 January 2022

Capital Economics has been commissioned by the Department for Digital, Culture, Media & Sport (DCMS) to model and report on the current and future use of artificial intelligence (AI) by UK businesses. The study is based on a combination of existing literature and survey evidence, official statistics, discussions with experts at DCMS and an original survey of businesses.

In this report we present indicative numbers about the current and potential future scale of AI adoption and expenditure in the UK under different scenarios, with splits by business size and sector. The purpose of the study is to add to the existing evidence base and to highlight results from the modelling and identification of barriers that may be of interest to policy makers and regulators, as well as broader stakeholders such as investors and AI companies themselves.

The definition of AI used in this report is based on five technology categories: machine learning, natural language processing and generation, computer vision and image processing/generation, data management and analysis, and hardware. A business is classed as having adopted AI if it uses at least one of these technologies. Expenditure is broken down by spending on these AI technologies and the cost of labour that is related to the development, operation or maintenance of them. All results should be considered as estimates; they are based on modelling conducted using survey results and publicly available statistics.

The five key findings of this report are:

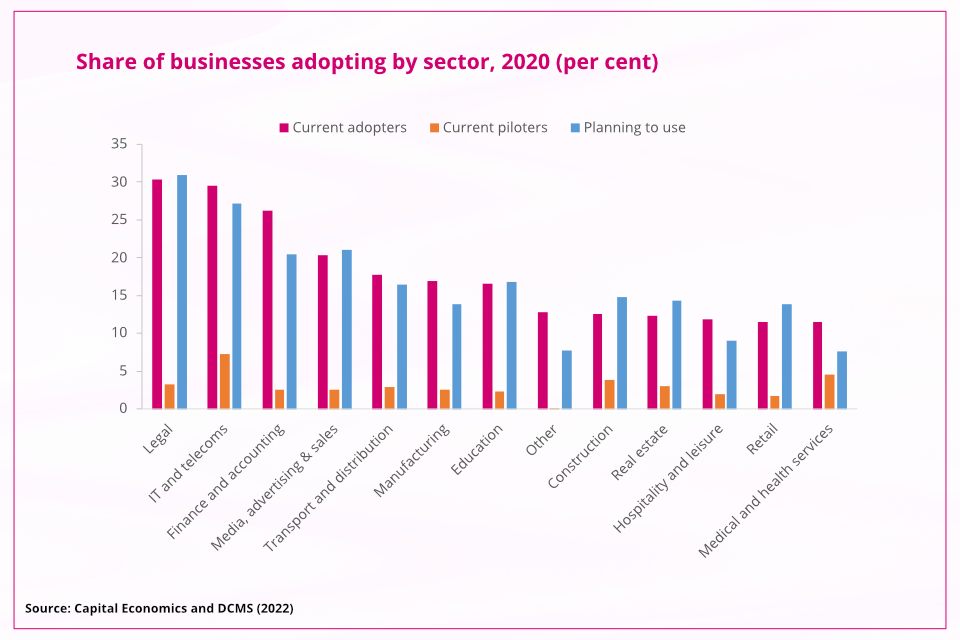

1. Current usage of AI technologies is limited to a minority of businesses, however it is more prevalent in certain sectors and larger businesses

-

Around 15% of all businesses have adopted at least one AI technology, which translates to 432,000 companies.

-

Around 2% of businesses are currently piloting AI and 10% plan to adopt at least one AI technology in the future, equating to 62,000 and 292,000 businesses respectively.

-

As businesses grow, they are more likely to adopt AI; 68% of large companies, 34% of medium sized companies and 15% of small companies have adopted at least one AI technology; the latter make up the majority of the UK business landscape and hence drive the UK average result of a 15% adoption rate.

-

AI solutions for data management and analysis are most prevalent, with 9% of UK firms having adopted them, followed by natural language processing and generation (8%), machine learning (7%), AI hardware (5%), computer vision and image processing and generation (5%).

-

The IT and telecommunications (29.5%) and legal (29.2%) sectors currently have the highest rate of adoption, while the sectors with the lowest adoption rates are hospitality (11.9%), health (11.5%), and retail (11.5%).

- Large companies are more likely to adopt multiple AI technologies, however there are innovative companies using multiple AI technologies across all size brackets; around 480 large firms (20%), 1,500 medium firms (8%) and 49,300 (3%) small firms are currently using four or five AI technologies to assist in their business activities.

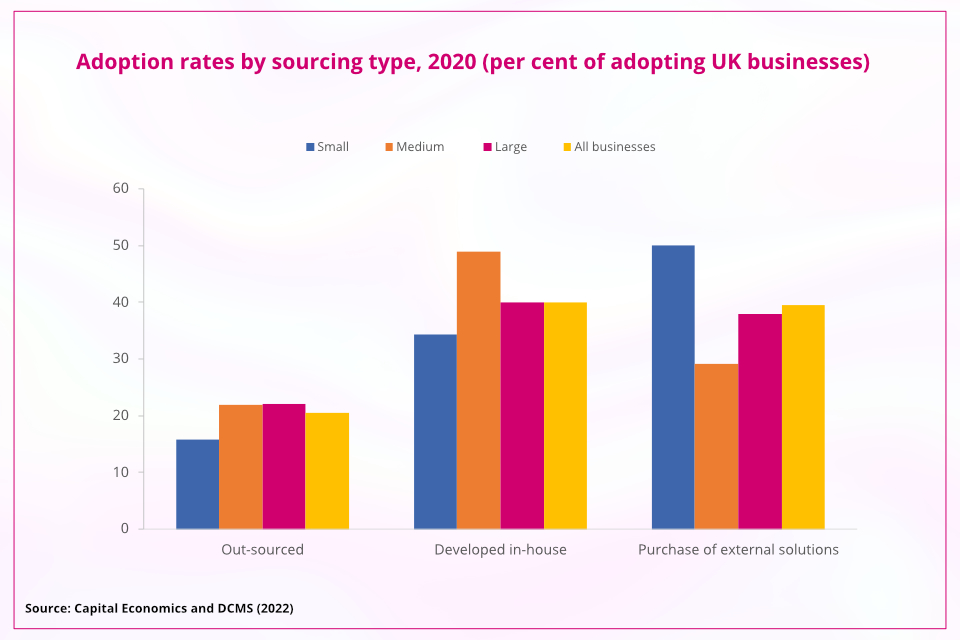

2. Different routes are used by businesses to source AI technologies

-

Approximately 40% of businesses (172,000 firms) that have adopted AI primarily develop it in-house and 40% (171,000 firms) purchase ‘off-the-shelf’ solutions; the remaining 20% (88,500 firms) out-sourced the development of AI applications to external providers.

-

Medium sized firms were the most likely to develop AI solutions in-house. Around 49% of these firms did this compared to 40% of large firms and 34% of small firms.

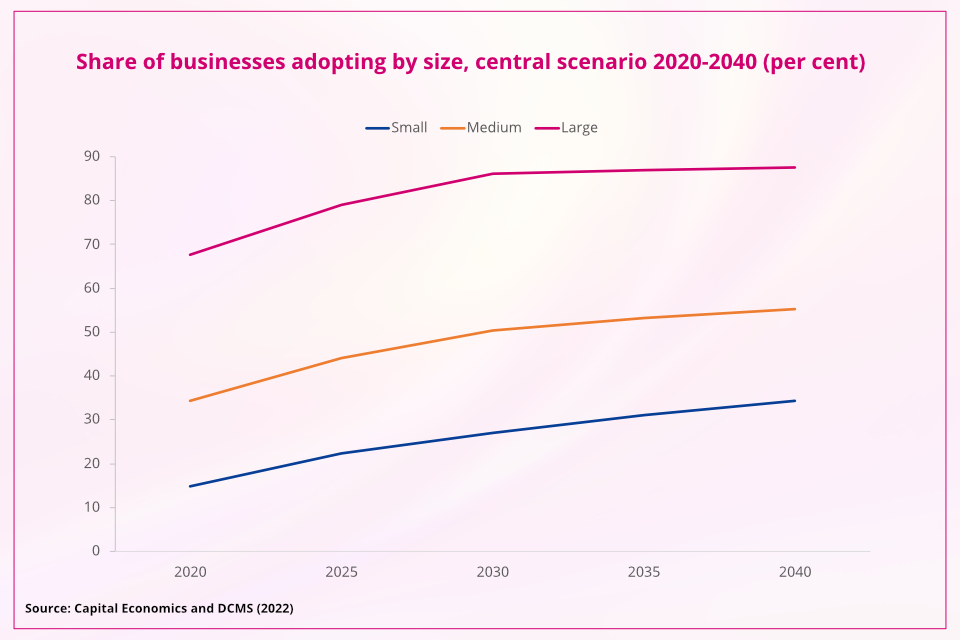

3. The scope for increased adoption is large if conditions are right

-

In our central scenario, the adoption rate increases from 15.1% in 2020 to 22.7% in 2025, with an additional 267,000 businesses using AI in their operations.

-

The adoption rate for small firms increases by 7.6 percentage points between 2020 and 2025 compared to 9.7 percentage points in medium sized companies and 11.2 percentage points in large companies.

-

By 2040, the overall adoption rate will reach 34.8%, with 1.3 million businesses using AI in the central scenario.

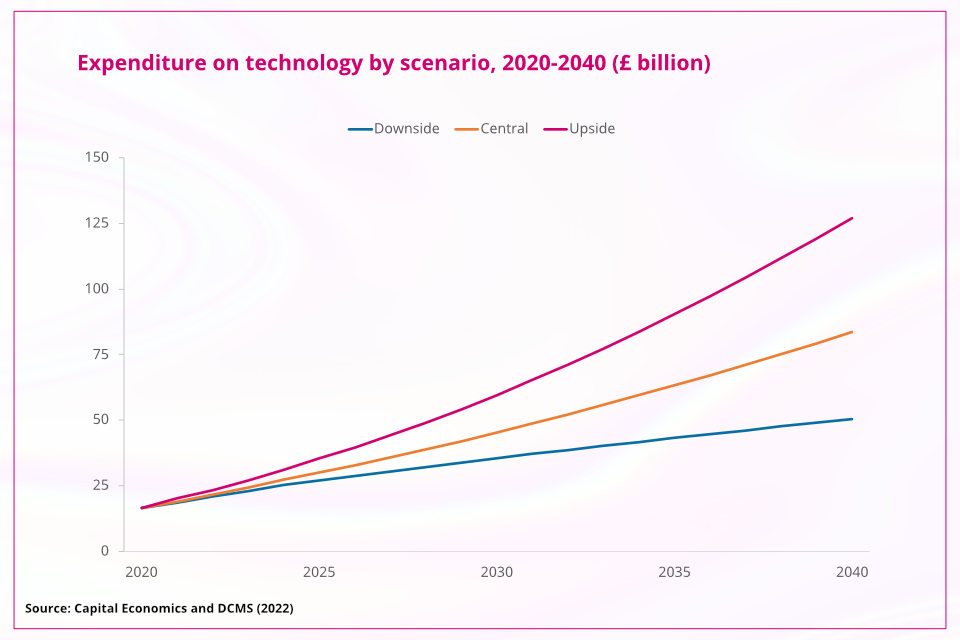

4. Future spending on AI technologies is set to increase, but has a wide range of possible trajectories

-

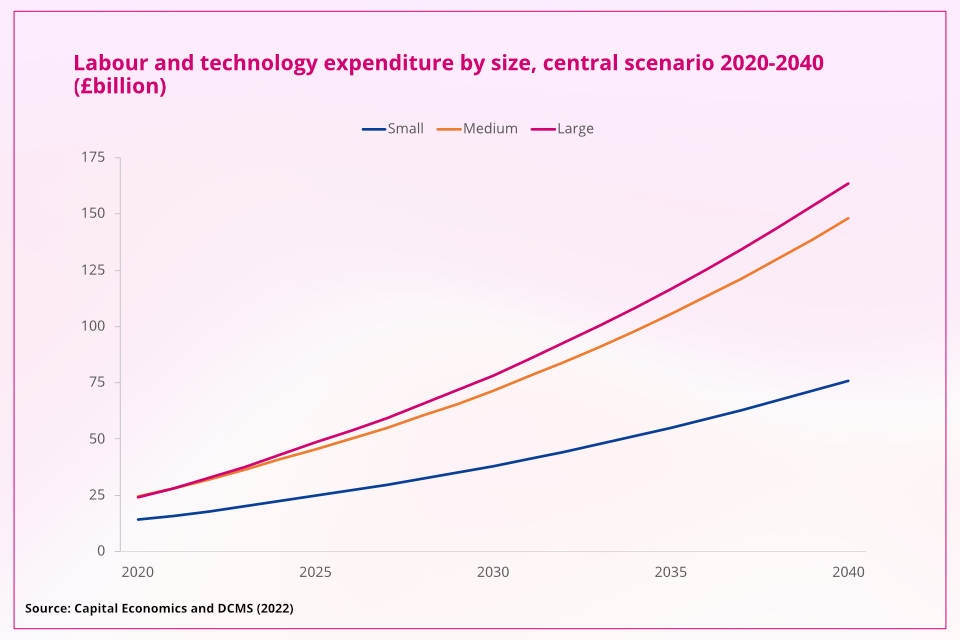

In 2020, the 432,000 companies in the UK who have already adopted AI, spent a total of £16.7 billion on AI technologies. The average spend was £9,500 per small business, £380,000 per medium business and £1.6 million per large business.

-

Expenditure on AI technologies could increase to between £27.2 billion and £35.6 billion by 2025, at annual growth rates of roughly 10% and 16% respectively. In the central scenario, expenditure rises from £16.7 billion to £30.3 billion at a compound annual growth rate of 12.6%. Overall, between 2020 and 2040 expenditure on AI technologies increases from £16.7 billion to £83.5 billion in 2040 at a compound annual growth rate of 8.4% in our central scenario.

-

In the downside scenario, AI technology expenditure increases to £50.4 billion by 2040 at an annual growth rate of 5.7% and in the upside scenario it increases to £127 billion at an annual growth rate of 10.7%.

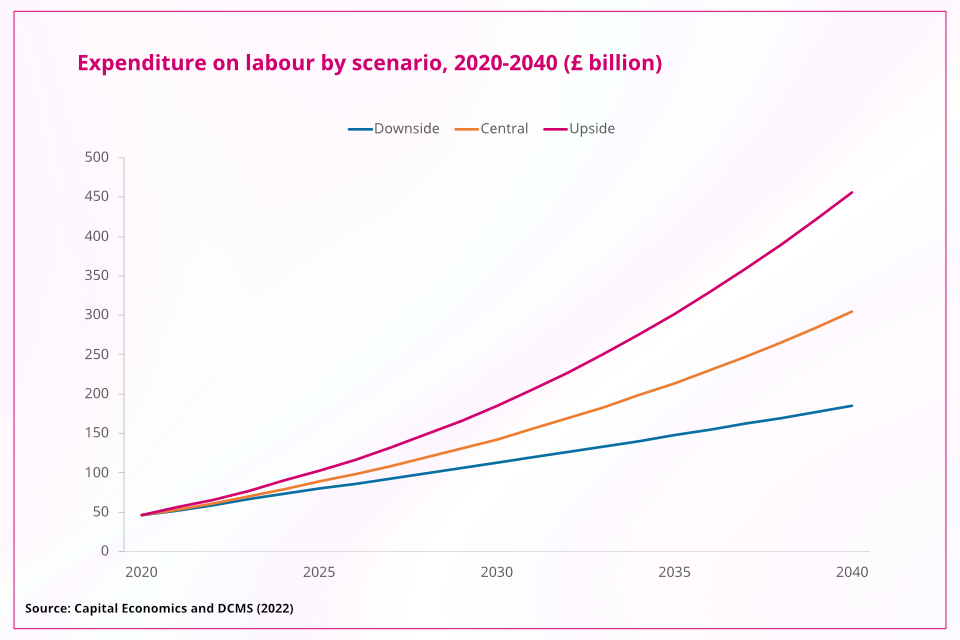

5. Spending on labour related to AI will to increase to support AI technologies’ rising prevalence

-

In 2020, the 432,000 companies in the UK who have already adopted AI, spent a total of £46.0 billion on labour associated with the development, operation or maintenance of those technologies.

-

The average labour spend was £24,400 per small business, £1.7 million per medium business and £3.1 million per large business.

-

Expenditure on AI related labour could increase to between £80.2 billion and £103.2 billion by 2025, at annual growth rates of roughly 11.7% and 17.5% respectively. In the central scenario, expenditure rises from £46.0 billion to £88.7 billion at a compound annual growth rate of 14%. In our central scenario, expenditure on labour related to the development, operation or maintenance of AI technologies increases from £46.0 billion in 2020 to £304.2 billion in 2040 in nominal terms at a compound annual growth rate of 9.9%.

-

In the downside scenario, AI labour expenditure increases to £185.2 billion by 2040 at an annual growth rate of 7.2% and in the upside scenario it increases to £456.0 billion at an annual growth rate of 12.1%.