February 18, 2021

TradePending’s Annual Consumer and Dealer Surveys

What do consumers and dealers want from each other when visiting a dealer’s website?

They really want the same things:

- Easy to find information about inventory

- How to value a trade-in

- Accurate values on those trade-ins

We’ve conducted consumer surveys for the last six years. This year, we’re bringing the data out of our pitch decks and into the public realm for the first time.

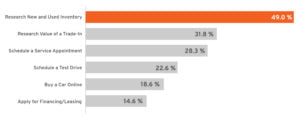

When visiting an auto dealership’s website, what services would you value?

This is such a simple question to ask, and with just a few responses you can easily refine your website strategy.

When visiting an auto dealership’s website, what services would you value?

Methodology: conducted by Google Consumer Surveys, January 2021. N = 1,469.

When you, the dealer, visit your own website, are you making it easy for consumers to easily take action on those first three items? Most dealerships nail the first and most important category: showcasing their inventory. If you’re burying the trade-in tool or lead form as a sub-menu deep under the finance navigation, you’re ticking off a third of your website visitors. And when they’re ticked, they bounce from your site to your competitors’ and third parties. Check out Kia Country of Charleston for a great example of getting all three placements right.

In the six years that we’ve been running these surveys, those top three items haven’t changed order a single time. A few years ago we did add the option for buying a car online. That number has been inching up slowly, obviously accelerating a bit in 2020, because…pandemic.

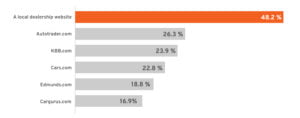

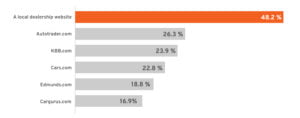

When shopping for a car, I would visit the following websites

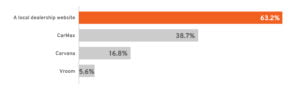

We asked the next question to two different survey groups, with one focused primarily on third party sites, and the other on the big box / digital retailer segment.

In both cases, dealerships should take some comfort in knowing that consumers place significant value in their online presence.

When shopping for a car, I would visit the following websites

Methodology: conducted by Google Consumer Surveys, January 2021. N = 1,503

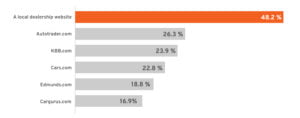

When shopping for a car, I would visit the following websites

Methodology: conducted by Google Consumer Surveys, January 2021. N = 1,502

In our final question, we turned to dealers to understand what matters most to them when it comes to trade-in tools. Given that we’re the makers of Trade & Offer , the industry’s highest converting trade-in tool and most customizable trade-in offer solution (respectively), this question is a natural fit for us.

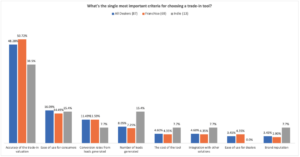

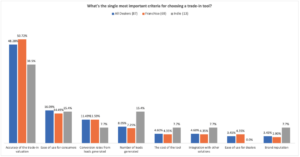

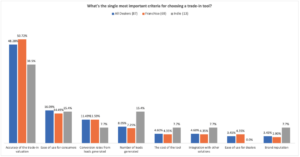

What’s the single most important criteria for choosing a trade-in tool?

Methodology: conducted by DrivingSales & TradePending, January 2021. N = 87

The clear winner across franchise and independent dealers is accuracy. “Trade-in tool” can mean different things to different dealers, from a website conversion plug-in to a full-blown appraisal solution.

Our customers love Trade because of its powerful one-two punch of high volume lead conversion and accuracy. That accuracy comes from two things:

- Using local retail market data to determine a vehicle’s value, instead of national and regional averages that are irrelevant to a specific area.

- The ability for dealers to customize their fees in order to reflect their actual costs to make a vehicle front-line ready.

Coming in last place – brand reputation.

Dealers, you know your customers best. Use this consumer data to help adapt and refine your online strategy. When it comes to accuracy, transparency, ease of use, and return on investment, how does your current solution stack up? For help with the right questions to ask, check out our “Dealer’s Guide to Selecting a Trade-in Tool”, or just schedule a demo with our team right now.