Professional Documents

Culture Documents

Service and Facility Quality Factors On Loyalty With Satisfaction As An Intervening Variable in Mekaar Sharia Financing PT. PNM Area Bandung 4

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Service and Facility Quality Factors On Loyalty With Satisfaction As An Intervening Variable in Mekaar Sharia Financing PT. PNM Area Bandung 4

Copyright:

Available Formats

Volume 6, Issue 9, September – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

Service and Facility Quality Factors on Loyalty with

Satisfaction as an Intervening Variable in Mekaar

Sharia Financing PT. PNM Area Bandung 4

Ajeng Ratih Puspawati

Student of Magister Management, Perbanas Institute

Jakarta, Indonesia

Abstract:- The purpose of this study was to analyze the the market share of the Islamic financial services industry is

effect of service quality and facilities on customer still relatively low at 9.90% of total national assets, the

satisfaction and loyalty of Mekaar Syariah Area Bandung differentiation of Sharia business models/products is also still

4 at PT. PNM. The research method used is quantitative limited so that innovation and creativity are needed for service

through primary data analysis using questionnaires on industry players. Islamic finance, then it is necessary to

certain populations or samples, namely customers of increase the adoption of technology to keep up with

Mekaar Syariah Bandung Area 4 PT. PNM. The main increasingly fast and dynamic technological developments, as

research instrument is quantitative/statistical data well as the need for human resources with expertise in Islamic

analysis which requires the use of a question structure economics and finance to keep up with various dynamics and

where answer choices have been provided with a sample changes in economic and technological conditions. In

of respondents. The type of research used is quantitative addition, due to the global Covid19 pandemic, the global

research with AMOS version 24 data processing tool. The situation we are currently facing has forced us to enter the era

research hypothesis shows that the service and facility of a new normal. This new normal era has changed the pattern

quality variables have a significant and positive effect on of social, community and economic life, increased vigilance,

satisfaction, the satisfaction variable has a significant and and required physical distance when interacting. On the other

positive effect on customer loyalty, and the service quality hand, people are increasingly worried about helping others,

variable has a significant and positive effect on customer especially on financial issues. This is both a challenge and an

satisfaction. customer loyalty Mekaar Syariah PT. PNM. opportunity for Islamic financial institutions. They can

provide services to meet the social needs of the community

Keywords: Quality of Service, Facilities, Customer and thus play a role in the economic construction of the people

Satisfaction, Customer Loyalty. after the pandemic.

I. INTRODUCTION PT PNM as one of the SOEs in the form of a special

non-bank financial institution owned by the Government also

The Islamic finance economy and industry in Indonesia supports the direction of sharia industry development through

has the potential to continue to be developed, one indicator of strengthening Islamic financial institutions that play a role in

which is that 87 percent or the equivalent of 230 million channeling financing for MSMEs. PT.PNM's sharia financing

Indonesians are Muslims. The sharia industry is not only in program is carried out through the Sharia Prosperous Family

demand by countries with a majority Muslim population, even Economic Development Program (Mekaar) and the Sharia

in other countries such as Japan, Thailand, the UK and the US. Micro Capital Service Unit (ULaMM). PNM Mekaar Syariah

To encourage the growth of the sharia industry in Indonesia, is a group-based empowerment service in accordance with the

the government through the 2020-2024 National Medium- provisions of Islamic law based on a fatwa and/or a statement

Term Development Plan (RPJMN) and the 2019-2024 of conformity to sharia from the National Sharia Council of

Indonesian Islamic Economics and Finance Master Plan the Indonesian Ulema Council aimed at underprivileged

created a sharia economic development framework that women who are ultra-micro business actors, through:

focuses on the main sectors of strengthening the halal value Improved financial management to realize ideals and family

chain including the food and beverage cluster, fashion, welfare, Business capital financing without collateral,

tourism, media and recreation, and pharmacy and cosmetics. Familiarization with saving culture, Increasing entrepreneurial

In order to achieve maximum results, the development of competence and business development. Meanwhile, Sharia

various clusters has also been accompanied by the ULaMM is a financing distribution carried out in accordance

strengthening of Islamic finance, small, medium and micro with sharia principles based on a fatwa and/or sharia

enterprises, and the digital economy. Islamic financial conformity statement from the National Sharia Council of the

institutions must be able to respond immediately, including Indonesian Ulema Council for MSME business actors.

maximizing the development of the true halal industry, which

has so far been very strong in terms of the growth and position In order to improve the quality of Mekaar Syariah

of the true halal industry in Indonesia. However, some of the services to satisfy customers which leads to customer loyalty

challenges faced must be addressed immediately, including: to PT.PNM. Islamic financial institutions, which are service

IJISRT21SEP397 www.ijisrt.com 460

Volume 6, Issue 9, September – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

industries, must improve the quality of their services. Service the regression coefficient analysis between the dimensions of

quality is defined as the extent to which a company's services service quality, it has a positive effect on customer satisfaction

meet or exceed customer expectations (Parasuraman et al., with service quality. Where the effect of changes in the ups

1985; Zeithamel et al., 1996). Service quality is the expected and downs of service quality variables on customer

level of excellence and control over the level of excellence to satisfaction is significant. (Sofyan, Pradhanawati & Nugraha)

meet customer expectations. Good and effective service found that facilities, service quality and satisfaction had a

quality will increase and have an impact on customer positive and significant effect on loyalty. However, Evan

satisfaction and loyalty. Thus the quality of service must be Chandra's research (2018) reveals that service quality does not

managed professionally (Lovelocket al., 2001). The purpose directly have a significant effect on customer loyalty.

of service management is to achieve a certain quality of Although in this study it was found that the value received by

service which is closely related to customer satisfaction and customers and service quality had a positive and significant

customer loyalty. According to Tjiptono (2015:111) Loyalty is effect on employee loyalty through customer satisfaction. The

a situation where consumers have a positive attitude towards relationship between facilities, service quality, and customer

the product or producer and are accompanied by a consistent satisfaction results in different and varied conclusions. On

pattern of repeat purchases. In this case, loyalty describes the some of the previous studies, the re-examination of the

consumer's desire to continue to subscribe in the long term, relationship between facilities, service quality on customer

make purchases and use goods and services repeatedly and satisfaction and the effect on loyalty will be carried out at PT.

recommend the company's products to friends or family. Madani Business Partner.

Research on the service quality of Islamic financial Based on the phenomenon and research gap, further

institutions has not widely used compliance to measure the research is needed between the relationship between facilities,

quality of services provided by Islamic financial institutions to service quality and satisfaction that affects customer loyalty

customers. Since Islamic financial institutions are Islamic Mekaar Syariah is very necessary to improve customer

financial institutions, researchers believe that compliance is satisfaction which leads to loyalty to Mekaar Syariah

important for assessing service quality. In order for customers PT.PNM.

to have confidence in the services provided, customers must

regard service quality as positive. One of the important pillars II. LITERATURE REVIEW

of the development of Islamic financial institutions is

compliance with Sharia law. This pillar is the main difference A. Service Quality

between Islamic financial institutions and traditional financial The concept of service quality in an Islamic perspective

institutions. To ensure that Shariah banks and financial is a form of cognitive evaluation from consumers on the

institutions apply Shariah principles, Shariah supervision is presentation of services by service organizations that rely each

required, which is implemented by the Shariah Supervision of their activities on moral values and according to compliance

Committee (DPS). The number of DPS members is at least 2 as explained by Islamic law (Othman and Owen, 2001).

(two) people and a maximum of 5 (five) people for Sharia According to Saeed et al. (2001), there are three characteristics

Commercial Banks and Sharia Business Units. The of marketing ethics from an Islamic perspective. First, Islamic

government has issued two laws that position the Sharia marketing ethics is based on the Koran and leaves no room for

Supervisory Board strategically to ensure compliance with ambiguous interpretation. Second, the main difference is the

sharia principles in Islamic banking and financial institutions. transcendental aspect of absoluteness and non-softness. Third,

(Muhammad, 2011, p.31) Bela Dwi Kuntari (2016) in a study the Islamic approach that emphasizes maximizing value in

entitled "The Effect of Service Quality on Customer view of the good in society rather than pursuing personal

Satisfaction and Loyalty at PT Astra Internasional Tbk". The selfishness by maximizing profit. Othman and Owen (2001)

research results show that service quality has a significant introduce six dimensions to measure service quality in

impact on satisfaction. Although satisfaction has no significant financial institutions with sharia principles, by adding an

impact on customer loyalty, service quality has a significant element of "compliance" to the service quality dimension.

positive impact on customer loyalty. Compiance with Islamic Law (compliance with Islamic law).

The five dimensions of service quality plus compliance as

Taufiq Risal (2018) in his research titled "The influence product requirements are better known as CARTER.

of service quality on customer loyalty and satisfaction as an

intervention variable for BMT Kampoeng Syariah". The B. Facilities

research results show that service quality has a positive and Facilities are everything that is intentionally provided by

significant impact on satisfaction, satisfaction has a positive Islamic Financial Institutions as service providers to be used

and significant impact on customer loyalty, and service quality and enjoyed by customers with the aim of providing the

has a positive and significant impact on customer loyalty. maximum level of satisfaction. Facilities are all physical

Service quality does not affect customer loyalty BSM savings, facilities provided by Islamic financial institutions for the

service quality affects customer loyalty BSM savings. convenience of customers (Kotler, 2009). Lupioadi (2008)

believes that facilities are the appearance, capabilities, and

While the research conducted by Muchlis (2012) entitled conditions of an infrastructure that show its existence to the

“The influence of service quality dimensions on the level of outside world, including physical facilities (buildings),

customer satisfaction at PT. Bank Rakyat Indonesia (Persero) equipment, and appliances. Facilities include tools, objects,

Tbk. Ahmad Dani Makassar Branch”, Based on the results of equipment, money, and work space. Tjiptono (2006) believes

IJISRT21SEP397 www.ijisrt.com 461

Volume 6, Issue 9, September – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

that the design of service facilities is closely related to the

formation of customer perception. For many types of services,

the perception generated by the interaction between customers

and facilities will affect the quality of these services in the

eyes of customers.

C. Customer Satisfaction

Kotler (2009: 139) said that satisfaction is a person's

feeling of joy or disappointment when comparing the

perceived performance of a product with their expectations. If

the performance does not meet expectations, customers will be

dissatisfied. If the performance meets expectations, the Fig 1: -Theoritical Framework

customer will be satisfied. If the performance exceeds

expectations, the customer will be very satisfied or happy. The F. Hypothesis

definition of customer satisfaction or dissatisfaction is the The hypothesis of this cases that could be seen as in

customer's response to the perceived difference between the follows:

evaluation of previous expectations (or other performance H1: Service quality has a positive and significant impact on

specifications) and the actual performance experienced by the customer satisfaction Mekaar Syariah Bandung Area 4

product after use (Tjiptono, 1996). Customer satisfaction is the H2: The facilities provided have a significant positive effect

key to customer loyalty. Achieving a high level of customer on customer satisfaction Mekaar Syariah Bandung Area 4

satisfaction brings many advantages to the company, that is, in H3: Service quality has a significant positive effect on

addition to increasing customer loyalty, it can also prevent customer loyalty Mekaar Syariah Bandung Area 4

customer volatility, reduce customer price sensitivity, H4: The facilities provided have a significant positive effect

maximize profits, reduce the cost of marketing errors, and on customer loyalty Mekaar Syariah Bandung Area 4

reduce the number caused by increasing The operating costs of H5: Customer satisfaction has a significant positive effect on

customers. , Improve advertising effectiveness and improve customer loyalty Mekaar Syariah Bandung Area 4

company reputation. (Dwi Aryani and Febrina Rosnita, 2010).

III. METHODOLOGY

D. Customer Loyalty

Customer satisfaction is the most important indicator of This research was conducted using descriptive analysis

customer loyalty. Customers who are satisfied with Islamic method with a quantitative approach. The unit of analysis is

banking services will convert their feelings into loyalty, which the customer of PT.PNM Mekaar Syariah Bandung Area 4 in

is clearly reflected in the continuous repurchase and the Bandung Regional area, West Java. Bandung area 4

suggesting others to purchase products and services from consists of 5 branches with the number of respondents of

Islamic banks. Customers who are satisfied with the value and Mekaar sharia customers as many as 818 respondents, namely

quality of the product or service may remain loyal for a long Mekaar customers who are all women who have productive

time (Umar 2000). Early research has shown that, among other businesses. The type of data from the research variables used

things, customer satisfaction has a positive impact on in the study is primary data. In managing the results in the

company image (Kian et al., 2013), return on purchases form of raw data, the research carried out data processing

(Dkudiene et al., 2015), and customer value (Zameer et al., using AMOS (Analysis of Moment Structure) software

2013). 2015). , Customer loyalty (Mohsan et al., 2011; version 24.0 which is used in the general approach of data

Andreassen & Lindestad, 1998) and the negative impact on analysis in the Structural Equation Model or better known as

conversion intentions (Martins et al., 2013; Zhang et al., 2012; SEM..

Mohsan et al., 2011; Walsh & Dinnie , 2006). According to

Tjiptono (2016: 110), loyalty is a customer's commitment to a

brand, company, or supplier. This commitment is based on a

positive attitude and is reflected in consistent purchases.

According to Kotler (2016: 18), customer loyalty is now a

measure of the relationship between a customer and a product

or service, which is reflected in the desire to recommend it.

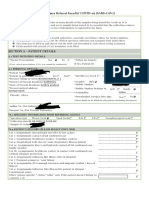

E. Theoritical Framework

Based on these theory above, it could be described a

theoritical framework for these titles as follows:

Fig2: - Structural Equation Model

IJISRT21SEP397 www.ijisrt.com 462

Volume 6, Issue 9, September – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

IV. RESULTS AND DISCUSSIONS Based on table 3 then the hypothesis test is as follows :

A. Validity and Reliability Test Hypothesis Testing 1

Table 1 shows that all the data in the research H1: Service quality has a positive and significant impact on

questionnaire meet the valid standard, and the measurement customer satisfaction/customers of Mekaar Syariah Bandung

result of the stress factor value or the validity coefficient of the Area 4. Result :C.R. of 6.908 > 1.967 and p value of 0.000 <

standardized stress estimation is 0.05. Therefore, all research 0.05. Then H1 is accepted so that it can be concluded that the

indicators can be used as effective data collectors to study quality of service has a positive and significant influence on

problems as research objects. customer satisfaction / customers of Mekaar Syariah Bandung

Area 4

TABLE 1. VALIDITY TEST RESULTS

Hypothesis Testing 2

The H2: The facilities provided have a significant positive

effect on customer satisfaction Mekaar Syariah Bandung Area

4. Result :C.R. of 6.127 > 1.967 and p value of 0.000 < 0.05.

Then H2 is accepted so that it can be concluded that the

facilities provided have a significant positive influence on

customer satisfaction/customers of Mekaar Syariah Bandung

Area 4

Hypothesis Testing 3

H3: Service quality has a significant positive influence on

customer loyalty Mekaar Syariah Bandung Area 4.

Result:C.R. Value of 10.019 > 1.967 and p value of 0.00 <

0.05. Then H3 is accepted so that it can be concluded that

service quality has a significant positive influence on customer

loyalty Mekaar Syariah Bandung Area 4

Hypothesis Testing 4

H4 : The facilities provided have a significant positive effect

on customer loyalty Mekaar Syariah Bandung Area 4.

According to Table 2, the CR value of each variable Result:C.R. Value of 8.434 > 1.967 and p value of 0.000 <

shows> 0.6. Therefore, all indicators of the research variables 0.05. Then H4 is accepted so that it can be concluded that the

can be used as effective data collectors to study the problems facilities provided have a significant positive influence on

as the research object. customer loyalty Mekaar Syariah Bandung Area 4.

TABLE 2. RELIABILITY TEST RESULTS Hypothesis Testing 5

H5: Customer satisfaction has a significant positive effect on

customer loyalty Mekaar Syariah Bandung Area 4.

Result:C.R. Value of 5.737 > 1.967 and p value of 0.000 <

0.05. Then H5 is accepted so that it can be concluded that

customer satisfaction has a significant positive influence on

customer loyalty Mekaar Syariah Bandung Area 4.

G. Hypothesis Test V. CONCLUSSION AND SUGGESTIONS

Analyze the results of SEM model data processing at all

stages using conformance testing and statistical testing. The Conclusion

data processing results of the analysis of the complete From the results of the analysis and hypothesis testing

Structural Equation Modeling (SEM) model are as follows: performed, it can be concluded that the quality of service has a

positive and significant impact on customer satisfaction. The

The results of the SEM analysis as a hypothesis testing above conclusion can be explained as that when the service

step are as follows: quality is good or increases, customer satisfaction increases.

The results of this study confirm the research conducted by

TABLE 3. HYPOTHESIS TESTING Misbach (2013) in Makassar that service quality plays a

positive and significant role in influencing consumer

satisfaction. Facilities have a positive and significant effect on

customer satisfaction. The conclusion above can be interpreted

that if service facilities are increased or said to be high, then

satisfaction will also increase. The results of this study

confirm that the research of Evan Chandra Kusuma (2018)

supports research that the value facilities received by

IJISRT21SEP397 www.ijisrt.com 463

Volume 6, Issue 9, September – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

customers have a positive and significant direct effect on Management, 13(2).

employee satisfaction and loyalty. Service quality has a https://doi.org/10.5539/ijbm.v13n2p138

positive and significant effect on loyalty. The conclusion [4]. Arli, D., Cherrier, H., & Tjiptono, F. (2016). God

above can be interpreted that if the quality of service increases blesses those who wear Prada: Exploring the impact of

or is said to be high, it will increase loyalty. The results of this religiousness on attitudes toward luxury among the

study confirm the research of Ishak & Azzahroh (2017), which youth of Indonesia. Marketing Intelligence & Planning.

supports research on the positive and significant impact of [5]. Bawono, A., & Oktaviani, M. F. R. (2016). Analisis

service quality on customer loyalty. The system has a positive Pemahaman, Produk, dan Tingkat Religiusitas terhadap

and significant impact on loyalty. The above conclusion can Keputusan Mahasiswa IAIN Menjadi Nasabah Bank

be explained as the increase in facilities, or higher, increasing Syariah Cabang Salatiga. Muqtasid: Jurnal Ekonomi

customer loyalty. The results of this study confirm the Dan Perbankan Syariah, 7(1), 29.

research of Evan Chandra Kusuma (2018) that facilities have a https://doi.org/10.18326/muqtasid.v7i1.29-53

positive and significant impact on satisfaction and loyalty. [6]. Ishak, M. Z., & Azzahroh, E. P. (2017). Pengaruh

Satisfaction has a significant positive effect on loyalty. The Kualitas Layanan Terhadap Loyalitas Nasabah Bank

above conclusion can be explained as that when employee Syariah Dengan Kepuasan Nasabah Sebagai Variabel

engagement increases or is marked as high, satisfaction will Intervening. Jurnal Ekonomi Dan Bisnis Islam (Journal

have an impact and it will reduce the willingness to fluctuate. of Islamic Economics and Business), 3(1), 26.

The results of this study confirm the research of Dwi Aryani https://doi.org/10.20473/jebis.v3i1.3599

and Febrina Rosnita (2010), who found that customer [7]. Kanzu, H. Al, & Soesanto, H. (2016). Analisis

satisfaction is the key to building customer loyalty. Pengaruh Persepsi Kualitas Pelayanan Dan Percieved

Value Meningkatkan Minat Menabung Ulang ( Studi

Suggestions Pada Bni Syariah Semarang ). Jurnal Studi Manajemen

This research still has limitations, including the sample & Organisasi, 13, 14–27.

used is limited to the unit of analysis limited to Mekaar [8]. Khaliq, R. (2019). Pengaruh Kualitas Pelayanan

customers in the Bandung area 4, for further research it is Terhadap Kepuasan Nasabah Bank Syariah Mandiri di

better to be thorough for regional and even national Mekaar Banjarmasin Kalimantan Selatan. RELEVANCE :

Syariah customers. This research is only limited to the Journal of Management and Business, 2(1), 177–

variables of facilities, service quality, satisfaction that affect 188. https://doi.org/10.22515/relevance.v2i1.1609

customer loyalty Mekaar Syariah. There needs to be further [9]. Khatab, J. J., Sabir Esmaeel, E., & Othman, B. (n.d.).

research on other variables that can affect customer loyalty of Dimensions of Service Marketing Mix and its Effects

Mekaar Syariah in terms of understanding, knowledge of on Customer Satisfaction: A Case Study of International

sharia products, religiosity, commitment and customer trust so Kurdistan Bankin Erbil City-Iraq Bestoon Othman Erbil

that a comprehensive picture can be obtained. Based on the polytechnic university Dimensions of Service

results of the questionnaire pooling to Mekaar Syariah Marketing Mix and its Effects on Customer Satisf.

customers conducted by the Account Officer (AO) with Retrieved March 28, 2021, from

relatively good results so that all analyzes describe a positive https://www.researchgate.net/publication/338169077

and significant effect. It needs to be tested if the questionnaire [10]. Prastiwi, I. E. (2018). Pengaruh Persepsi Anggota Pada

pooling is carried out by a more independent party that is not Sharia Compliance, Komitmen Agama dan Atribut

related to the interests of the customer. Produk Islam Terhadap Customer’s Trust Yang

Berdampak Pada Keputusan Menggunakan Jasa

REFERENCES Lembaga Keuangan Syariah (Studi Pada BMT Amanah

Ummah Sukoharjo). Jurnal Ilmiah Ekonomi Islam,

[1]. Al Yozika, F., Khalifah, N., Tinggi, S., Ekonomi, I., 4(01), 28. https://doi.org/10.29040/jiei.v4i1.162

Surakarta, A., & Tengah, J. (2017). [11]. Rahmatika, A. N. (2014). Dual Banking System di

PENGEMBANGAN INOVASI PRODUK Indonesia. At-Tahdzib: Jurnal Studi Islam Dan

KEUANGAN DAN PERBANKAN SYARIAH Muamalah, 2(2), 133–147.

DALAM MEMPERTAHANKAN DAN [12]. Risal, T., & Alexander, A. (2019). Pengaruh Persepsi

MENINGKATKAN KEPUASAN NASABAH. In Bagi Hasil, Promosi dan Kualitas Pelayanan Terhadap

JURNAL ILMIAH EDUNOMIKA (Vol. 01, Issue 02). Minat Penggunaan Jasa Perbankan Syariah Tabungan

www.ojk.go.id/.../syariah/.../Roadmap- [13]. Mudharabah Pada Mahasiswa Universitas Potensi

[2]. Ali, M., & Raza, S. A. (2017). Service quality Utama. Jurnal SamudraEkonomika,3(2),118–130.

perception and customer satisfaction in Islamic banks of https://ejurnalunsam.id/index.php/jse/article/view/1886

Pakistan: the modified SERVQUAL model. Total [14]. Sri Rahayu, Y., Setiawan, M., Wirawan Irawanto, D., &

Quality Management and Business Excellence, 28(5–6), Rahayu, M. (2019). Muslim customer perceived value

559–577. on customer satisfaction and loyalty: Religiosity as a

https://doi.org/10.1080/14783363.2015.1100517 moderation. https://doi.org/10.5267/j.msl.2019.11.009

[3]. Ali, Q., Sultan, I., Ali, S., & Correspondence, B. (2018). [15]. Dual Banking Systemdi Indonesiadalam Perspektif

Service Quality from Customer Perception: Evidence Politik Hukum Ekonomi Syari’ah. (n.d.). Retrieved

from Carter Model on Bank Islam Brunei Darussalam March 27, 2021, from

(BIBD). International Journal of Business and http://jurnal.staiannawawi.com/index.php/annawa/articl

e/view/123/127

IJISRT21SEP397 www.ijisrt.com 464

Volume 6, Issue 9, September – 2021 International Journal of Innovative Science and Research Technology

ISSN No:-2456-2165

[16]. Zuhirsyan, M., Keuangan, N. P., Perbankan, D.,

Jurusan, S., Politeknik, A., & Medan,

[17]. N. (2018). Pengaruh Religiusitas dan Persepsi Nasabah

terhadap Keputusan Memilih Bank Syariah. Al-Amwal :

Jurnal Ekonomi Dan Perbankan Syari’ah, 10(1), 48–62.

https://doi.org/10.24235/amwal.v10i1.2812

[18]. Harahap, D. A., & Amanah, D. (2019). Kajian Kualitas

Pelayanan dan Loyalitas Nasabah Perbankan di

Indonesia. Jurnal Bisnis Dan Ekonomi, 26(1).

[19]. Othman, A., & Owen, L. (2001). Adopting and

measuring customer service quality (SQ) in Islamic

banks: a case study in Kuwait finance house.

International Journal of Islamic Financial Services, 3(1),

1-26.

[20]. Kotler, P. (2011). Philip Kotler's contributions to

marketing theory and practice. In Review of Marketing

Research: Special Issue–Marketing Legends. Emerald

Group Publishing Limited.

IJISRT21SEP397 www.ijisrt.com 465

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Seal Plans As Per API 682Document66 pagesSeal Plans As Per API 682janamuraliNo ratings yet

- BLADED - Theory Manual PDFDocument134 pagesBLADED - Theory Manual PDFdavidlokito100% (2)

- Method Statement For Planter WaterproofingDocument8 pagesMethod Statement For Planter WaterproofingMonali Varpe0% (1)

- The Mini-Guide To Sacred Codes and SwitchwordsDocument99 pagesThe Mini-Guide To Sacred Codes and SwitchwordsJason Alex100% (9)

- An Analysis on Mental Health Issues among IndividualsDocument6 pagesAn Analysis on Mental Health Issues among IndividualsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Harnessing Open Innovation for Translating Global Languages into Indian LanuagesDocument7 pagesHarnessing Open Innovation for Translating Global Languages into Indian LanuagesInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Diabetic Retinopathy Stage Detection Using CNN and Inception V3Document9 pagesDiabetic Retinopathy Stage Detection Using CNN and Inception V3International Journal of Innovative Science and Research TechnologyNo ratings yet

- Investigating Factors Influencing Employee Absenteeism: A Case Study of Secondary Schools in MuscatDocument16 pagesInvestigating Factors Influencing Employee Absenteeism: A Case Study of Secondary Schools in MuscatInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Exploring the Molecular Docking Interactions between the Polyherbal Formulation Ibadhychooranam and Human Aldose Reductase Enzyme as a Novel Approach for Investigating its Potential Efficacy in Management of CataractDocument7 pagesExploring the Molecular Docking Interactions between the Polyherbal Formulation Ibadhychooranam and Human Aldose Reductase Enzyme as a Novel Approach for Investigating its Potential Efficacy in Management of CataractInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Making of Object Recognition Eyeglasses for the Visually Impaired using Image AIDocument6 pagesThe Making of Object Recognition Eyeglasses for the Visually Impaired using Image AIInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Relationship between Teacher Reflective Practice and Students Engagement in the Public Elementary SchoolDocument31 pagesThe Relationship between Teacher Reflective Practice and Students Engagement in the Public Elementary SchoolInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Dense Wavelength Division Multiplexing (DWDM) in IT Networks: A Leap Beyond Synchronous Digital Hierarchy (SDH)Document2 pagesDense Wavelength Division Multiplexing (DWDM) in IT Networks: A Leap Beyond Synchronous Digital Hierarchy (SDH)International Journal of Innovative Science and Research TechnologyNo ratings yet

- Comparatively Design and Analyze Elevated Rectangular Water Reservoir with and without Bracing for Different Stagging HeightDocument4 pagesComparatively Design and Analyze Elevated Rectangular Water Reservoir with and without Bracing for Different Stagging HeightInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Impact of Digital Marketing Dimensions on Customer SatisfactionDocument6 pagesThe Impact of Digital Marketing Dimensions on Customer SatisfactionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Electro-Optics Properties of Intact Cocoa Beans based on Near Infrared TechnologyDocument7 pagesElectro-Optics Properties of Intact Cocoa Beans based on Near Infrared TechnologyInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Formulation and Evaluation of Poly Herbal Body ScrubDocument6 pagesFormulation and Evaluation of Poly Herbal Body ScrubInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Advancing Healthcare Predictions: Harnessing Machine Learning for Accurate Health Index PrognosisDocument8 pagesAdvancing Healthcare Predictions: Harnessing Machine Learning for Accurate Health Index PrognosisInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Utilization of Date Palm (Phoenix dactylifera) Leaf Fiber as a Main Component in Making an Improvised Water FilterDocument11 pagesThe Utilization of Date Palm (Phoenix dactylifera) Leaf Fiber as a Main Component in Making an Improvised Water FilterInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Cyberbullying: Legal and Ethical Implications, Challenges and Opportunities for Policy DevelopmentDocument7 pagesCyberbullying: Legal and Ethical Implications, Challenges and Opportunities for Policy DevelopmentInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Auto Encoder Driven Hybrid Pipelines for Image Deblurring using NAFNETDocument6 pagesAuto Encoder Driven Hybrid Pipelines for Image Deblurring using NAFNETInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Terracing as an Old-Style Scheme of Soil Water Preservation in Djingliya-Mandara Mountains- CameroonDocument14 pagesTerracing as an Old-Style Scheme of Soil Water Preservation in Djingliya-Mandara Mountains- CameroonInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A Survey of the Plastic Waste used in Paving BlocksDocument4 pagesA Survey of the Plastic Waste used in Paving BlocksInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Hepatic Portovenous Gas in a Young MaleDocument2 pagesHepatic Portovenous Gas in a Young MaleInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Design, Development and Evaluation of Methi-Shikakai Herbal ShampooDocument8 pagesDesign, Development and Evaluation of Methi-Shikakai Herbal ShampooInternational Journal of Innovative Science and Research Technology100% (3)

- Explorning the Role of Machine Learning in Enhancing Cloud SecurityDocument5 pagesExplorning the Role of Machine Learning in Enhancing Cloud SecurityInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- A Review: Pink Eye Outbreak in IndiaDocument3 pagesA Review: Pink Eye Outbreak in IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Automatic Power Factor ControllerDocument4 pagesAutomatic Power Factor ControllerInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Review of Biomechanics in Footwear Design and Development: An Exploration of Key Concepts and InnovationsDocument5 pagesReview of Biomechanics in Footwear Design and Development: An Exploration of Key Concepts and InnovationsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Mobile Distractions among Adolescents: Impact on Learning in the Aftermath of COVID-19 in IndiaDocument2 pagesMobile Distractions among Adolescents: Impact on Learning in the Aftermath of COVID-19 in IndiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Studying the Situation and Proposing Some Basic Solutions to Improve Psychological Harmony Between Managerial Staff and Students of Medical Universities in Hanoi AreaDocument5 pagesStudying the Situation and Proposing Some Basic Solutions to Improve Psychological Harmony Between Managerial Staff and Students of Medical Universities in Hanoi AreaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Navigating Digitalization: AHP Insights for SMEs' Strategic TransformationDocument11 pagesNavigating Digitalization: AHP Insights for SMEs' Strategic TransformationInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Drug Dosage Control System Using Reinforcement LearningDocument8 pagesDrug Dosage Control System Using Reinforcement LearningInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- The Effect of Time Variables as Predictors of Senior Secondary School Students' Mathematical Performance Department of Mathematics Education Freetown PolytechnicDocument7 pagesThe Effect of Time Variables as Predictors of Senior Secondary School Students' Mathematical Performance Department of Mathematics Education Freetown PolytechnicInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Formation of New Technology in Automated Highway System in Peripheral HighwayDocument6 pagesFormation of New Technology in Automated Highway System in Peripheral HighwayInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Steady State Modeling and Simulation of The Oleflex Process For Isobutane Dehydrogenation Considering Reaction NetworkDocument9 pagesSteady State Modeling and Simulation of The Oleflex Process For Isobutane Dehydrogenation Considering Reaction NetworkZangNo ratings yet

- Samples For Loanshyd-1Document3 pagesSamples For Loanshyd-1dpkraja100% (1)

- Rick CobbyDocument4 pagesRick CobbyrickcobbyNo ratings yet

- 4-7 The Law of Sines and The Law of Cosines PDFDocument40 pages4-7 The Law of Sines and The Law of Cosines PDFApple Vidal100% (1)

- Tem 2final PDFDocument9 pagesTem 2final PDFSkuukzky baeNo ratings yet

- Adafruit Color SensorDocument25 pagesAdafruit Color Sensorarijit_ghosh_18No ratings yet

- LV 2000L AD2000 11B 16B Metric Dimension Drawing en 9820 9200 06 Ed00Document1 pageLV 2000L AD2000 11B 16B Metric Dimension Drawing en 9820 9200 06 Ed00FloydMG TecnominNo ratings yet

- BOM RMCC Parking-Shed Rev2Document15 pagesBOM RMCC Parking-Shed Rev2Ephrem Marx AparicioNo ratings yet

- Cellular Tower: Bayombong, Nueva VizcayaDocument17 pagesCellular Tower: Bayombong, Nueva VizcayaMonster PockyNo ratings yet

- 5e3 Like ApproachDocument1 page5e3 Like Approachdisse_detiNo ratings yet

- A Grammar of Awa Pit (Cuaiquer) : An Indigenous Language of South-Western ColombiaDocument422 pagesA Grammar of Awa Pit (Cuaiquer) : An Indigenous Language of South-Western ColombiaJuan Felipe Hoyos García100% (1)

- Continuous Improvement Strategies in TQMDocument28 pagesContinuous Improvement Strategies in TQMSimantoPreeomNo ratings yet

- Product Catalog Encoders en IM0038143Document788 pagesProduct Catalog Encoders en IM0038143Eric GarciaNo ratings yet

- India: Soil Types, Problems & Conservation: Dr. SupriyaDocument25 pagesIndia: Soil Types, Problems & Conservation: Dr. SupriyaManas KaiNo ratings yet

- Infrastructure Finance Project Design and Appraisal: Professor Robert B.H. Hauswald Kogod School of Business, AUDocument2 pagesInfrastructure Finance Project Design and Appraisal: Professor Robert B.H. Hauswald Kogod School of Business, AUAida0% (1)

- Boost productivity and networking with a co-working café in Iligan CityDocument4 pagesBoost productivity and networking with a co-working café in Iligan CityJewel Cabigon0% (1)

- Marine Ecotourism BenefitsDocument10 pagesMarine Ecotourism Benefitsimanuel wabangNo ratings yet

- RCD-GillesaniaDocument468 pagesRCD-GillesaniaJomarie Alcano100% (2)

- A APJ Abdul Kalam Technological University First Semester M. Tech. Degree Examination December 2016 Ernakulum II ClusterDocument2 pagesA APJ Abdul Kalam Technological University First Semester M. Tech. Degree Examination December 2016 Ernakulum II ClusterAshwin JoseNo ratings yet

- D-2 UTEP Currey Final ReportDocument23 pagesD-2 UTEP Currey Final ReporthmcNo ratings yet

- Course 4Document3 pagesCourse 4Ibrahim SalahudinNo ratings yet

- Topic 4a Presentation: Types of PatrolDocument4 pagesTopic 4a Presentation: Types of PatrolGesler Pilvan SainNo ratings yet

- Sample Id: Sample Id: 6284347 Icmr Specimen Referral Form Icmr Specimen Referral Form For For Covid-19 (Sars-Cov2) Covid-19 (Sars-Cov2)Document2 pagesSample Id: Sample Id: 6284347 Icmr Specimen Referral Form Icmr Specimen Referral Form For For Covid-19 (Sars-Cov2) Covid-19 (Sars-Cov2)Praveen KumarNo ratings yet

- Black Veil BridesDocument2 pagesBlack Veil BridesElyza MiradonaNo ratings yet

- Difference between Especially and SpeciallyDocument2 pagesDifference between Especially and SpeciallyCarlos ValenteNo ratings yet

- Main Application of Fans and BlowerDocument5 pagesMain Application of Fans and Blowermissy forlajeNo ratings yet