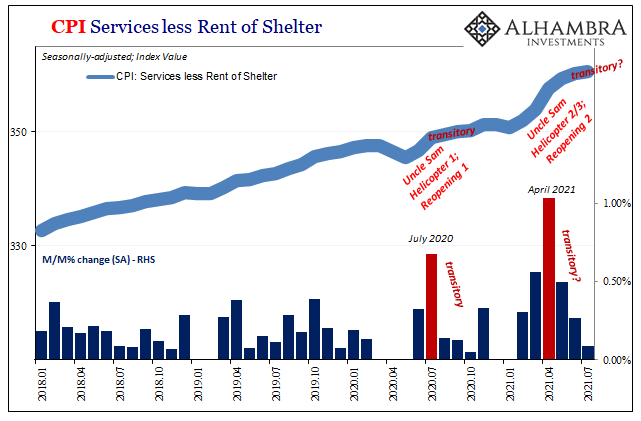

The recovery, or reflation, was sort of sailing along until suddenly it wasn’t. At least that was the impression anyone would’ve gotten from pretty much every mainstream source. The reality of the (global) economy’s rebound from last year’s recession was a touch more nuanced, having actually struggled quite a lot between Uncle Sam’s Helicopter #1 and #2; the hadn’t begun dispersing funds until the end of 2020.

Following #2 and then the bigger one from #3, however, you can understand why so much enthusiasm coloring not just future expectations but also blurring collective memories of the recent past. It all seems to blend into one huge deluge.

These federal government interventions aren’t just the largest, they are, we’re constantly reminded, gargantuan “stimulus” of the type no one has ever before attempted (not true, but this is the established narrative). An inflationary money tsunami no economic difficulties could possibly withstand, all our economic problems at once (or three times, but who’s counting?) washed away with the mere application of Janet Yellen’s signature.

Yet, over the past several months that same list of problems has only expanded, both in the number of them put down on it as well as the degree of difficulties experienced by those which never really left the catalog. Trying to reconcile this with the narrative, keeping inflation intact as many have to do to preserve their worldview, it must be corona’s delta.

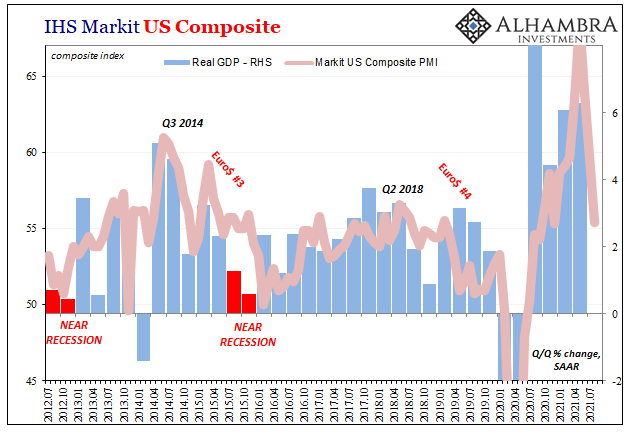

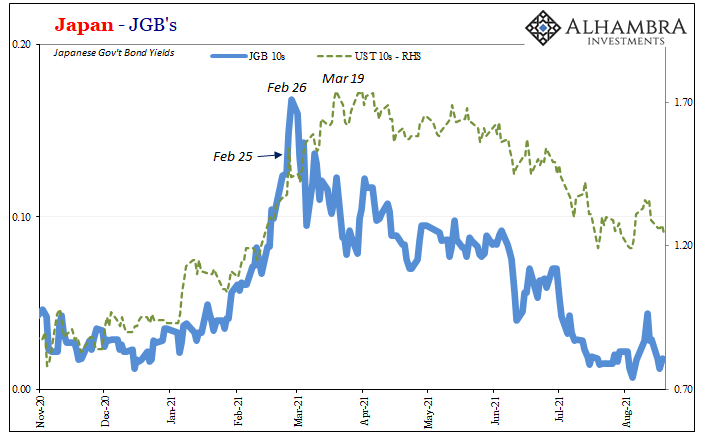

This possible inflection, though, goes much further back than the renewed political enthusiasm for COVID fearmongering. Recall that many global markets departed the only-ever modest reflation trade six months ago – on Feb 24-25. Even UST’s limped upward in nominal yields for only a few weeks longer before in mid-March succumbing to this “unexpected” realigning back into higher and higher deflationary potential.

Now the economic data gradually confirms this previewed pessimism.

While the Establishment Survey or headline payroll figures don’t indicate anything of the kind, convincing more of the easily-swayed FOMC empty suits to again turn to taper, the rest of the evidence is stacking up otherwise. Oh, the Federal Reserve will almost surely taper, it’s just for all the wrong reasons thereby repeating Ben Bernanke’s same 2013 mistake (or Jay Powell’s with rate hikes in 2018).

The headline labor market numbers have been either faulty (unemployment rate) or misinterpreted (“best jobs market in decades”) for much longer than this year. Following either without corroboration has led policymakers, the media, therefore the vast majority of the public to a series of errors further causing unhelpful confusion and obfuscation.

The economy is booming, according to those numbers, but no inflation ever shows up to confirm nor does it “feel” like the boom actually booms.

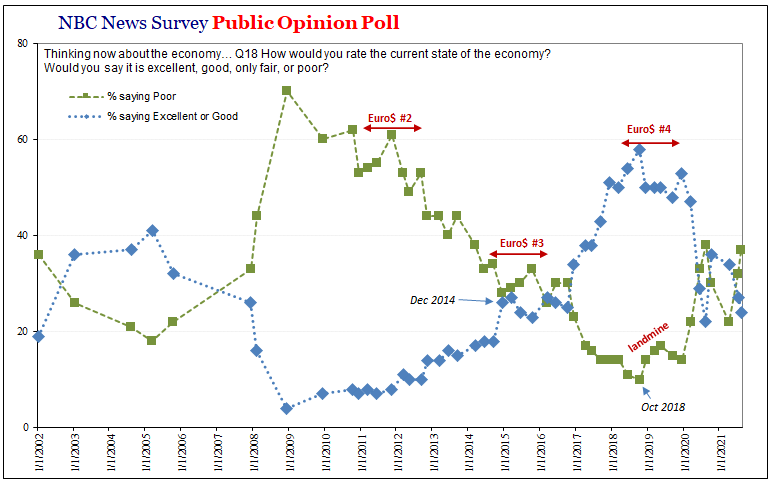

We can actually see this difference happen, and learn something important about what it means for 2021, using “soft” data consumer surveys. Whether University of Michigan or another, here I’ll highlight the results of NBC News polling because its latest were released just a few days ago.

While mostly dedicated to politics, and, as most polling, skewed heavily because of it, there has been one or two questions asked about the economy without any such baggage attached. Instead of asking how a President or Congress is handling it (presuming, wrongly, the economy is handled by anyone let alone politicians), for nearly two decades this set of surveys also queries the public’s opinion on raw economic “feel.”

Before getting to the more relevant recent trend, you can already see that cyclical economic weakness (global dollar shortages, or Euro$ #n) does temporarily intrude into the responses even though by and large these tallies pretty much line up in the big picture sense with something else guiding the overall perception:

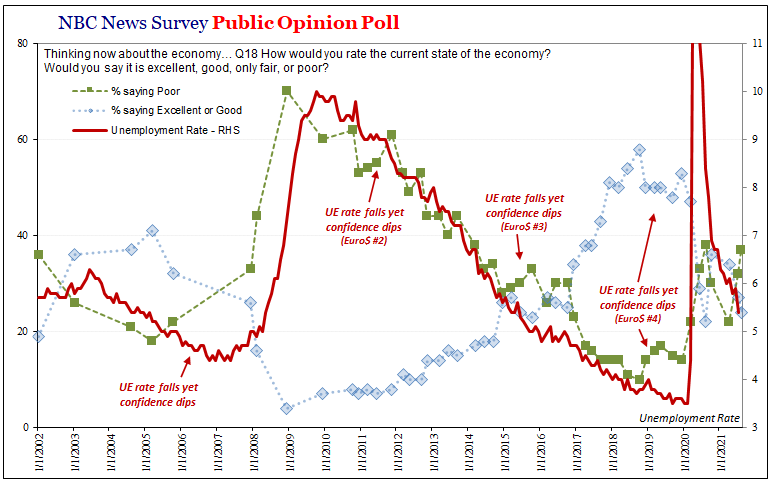

Quite naturally, most people don’t follow economic data very closely – or much at all. They might hear the occasional quarterly GDP estimate once in a while, though mostly people’s sensitivities are being set by the unemployment rate because of its simplicity and broad use. Incrementally, consumers/workers/employers calibrate their own perceptions of economic conditions based largely on these simple, widely-cited economic accounts even if deviating from them occasionally when these Euro$ #n’s rudely interrupt the more generally optimistic motion.

The most obvious example of this was 2018’s Jay Powell dichotomy; he, like the unemployment rate, went for seemingly inarguable inflation even as a few more of the surveyed told NBC’s pollsters something was amiss – because it was.

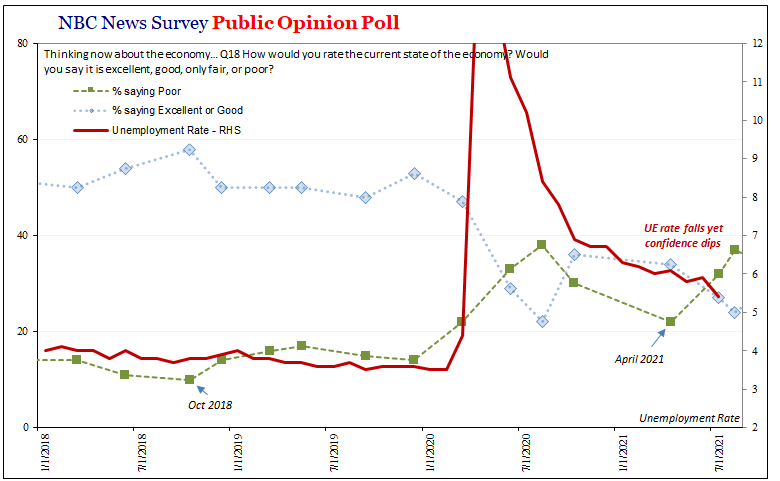

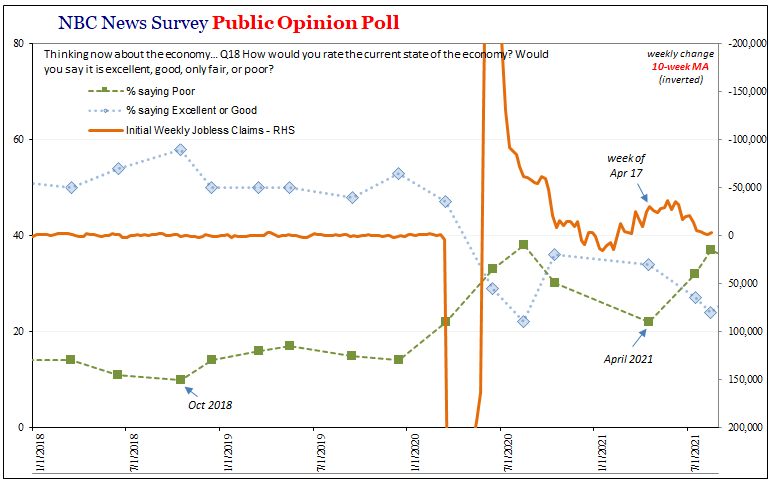

Moving forward to 2021, now back to the same sort of disconnect. The unemployment rate falling and last month falling faster while, as we’ve noted frequently, other data – including bond yields and curves – indicate basically the opposite.

In terms of this polling data, as you can see it has turned again more like the bond view rather than the unemployment rate view. As the latter drops, confidence has, too, which is the opposite of what you’d find in a red-hot recovery building toward its true inflationary takeoff.

In fact, the loss of confidence since April is itself alarming setting aside any part of the inflation debate.

Since that April survey, the proportion of those claiming the economy is either excellent or good has fallen ten points; from 34% (4% saying excellent; 30% saying good) to just 24% (2% excellent; 22% good). This includes a July survey panel in which the data then confirmed as a consistent waypoint between April and August.

Not surprisingly, then, the proportion who say they believe the economy is poor has risen substantially, from 22% in April to now 37% which nearly matches the worst number during 2020.

Again, we’ve seen this shift in many other data series and market prices (not stocks; almost never stocks).

Furthermore, we can also plainly see the same gap in the same data points going back to before the Great “Recession” showed up toward the end of 2007. Public polling data and consumer “confidence” can, at certain crucial times, tell us something that the unemployment rate or Establishment Survey cannot. This isn’t necessarily surprising, really, given that headline labor market data like those mentioned above is lagging.

For inflation, none of this is what you want to see if you are a FOMC suit with taper stuck in your head or of the reanimated multitudes of Jamie Dimons pitching the dollar’s crash and interest-rates-have-nowhere-to-go-but-up. In terms of inflation, yet more consistent evidence for “transitory” – though no longer having to hold one’s nose as much when using that word given how the Jay Powells are not so much for it as they had been not very long ago.

They always end up getting it backward before too long.

Beyond inflation, more importantly, an economy that is slowing like what is indicated here and everywhere else except the Establishment Survey and Unemployment Rate after still being in a huge hole or deficit is of only the same deflationary pit as we’ve become too familiar with and normalized to.

For one, “stimulus” isn’t stimulus outside the very short run. Once it runs its course, properly just ignoring all the QE’s, what’s left is instead way too much that’s always the same. And that’s the problem, while also the answer.

Stay In Touch