What is a 529?

529 plans were established to help parents and grandparents save money for post-secondary or higher education. Their many unique features – from low fees to tax-advantaged investing – make them one of the most popular ways to save for college.

CollegeChoice 529 offers:

- Tax-deferred investment growth

- Tax-free withdrawals for qualified expenses, like tuition, room and board, computers and laptops, and books1

- Gift- and estate-tax benefits

- Control by you over how assets are used

- Flexibility to use at eligible colleges, universities and vocational schools worldwide.2

More for tuition, less for taxes.

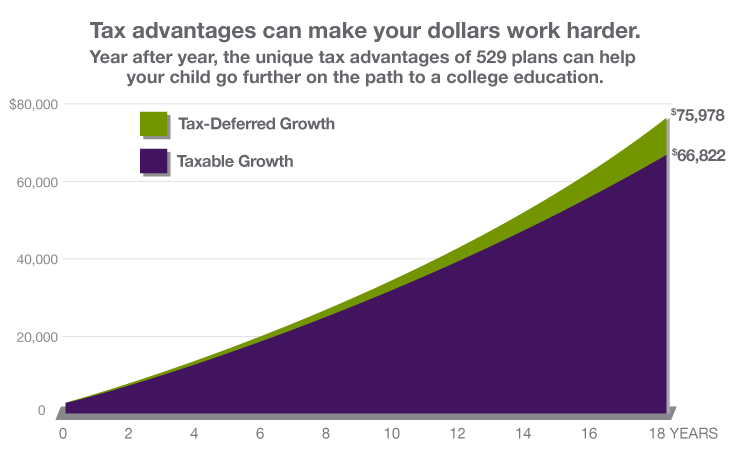

Unlike taxable college savings vehicles, 529 contributions can grow free of federal and state taxes.1 And the difference can be significant, as shown in the chart below.

If you open a 529 account with an initial investment of $2,500 and contributed $200 every month for 18 years, there could be over $9,100 more for qualified education expenses than the same investment in a taxable account.1

Assumptions: $2,500 initial investment with subsequent monthly investments of $200 for a period of 18 years; annual rate of return on investment of 5% and no funds withdrawn during the time period specified; taxpayer has a 24% Federal income tax rate for all options at the time of contributions and distribution. This hypothetical is for illustrative purposes only. It does not reflect an actual investment in any particular 529 plan or any taxes payable upon distribution. Actual investment returns may be higher or lower than those shown.

Little impact on financial aid.

Investing in a CollegeChoice 529 has little effect on your child's ability to qualify for financial aid under FAFSA.

If your child is a dependent and you are the account holder, a 529 plan is considered to be your asset. So, only 3-6% of the 529's total account value will be counted toward your Estimated Family Contribution (EFC), as determined from FAFSA.

Financial aid programs offered by educational institutions and other non-federal sources may have their own guidelines for the treatment of 529 plan accounts. For more information about financial aid eligibility, you should consult with a financial aid professional and/or the state or educational institution offering a particular financial aid program.3

1 Earnings on non-qualified withdrawals are subject to federal income tax and may be subject to a 10% federal penalty tax, as well as state and local income taxes. The availability of tax or other benefits may be contingent on meeting other requirements.

2 An eligible institution is one that is eligible for federal financial aid programs.

3 Federal and non-federal financial aid program treatments of assets in a 529 plan are subject to change at any time. You should research and periodically monitor the applicable laws and other official guidance, as well as particular program and institutional rules and requirements to determine the impact of 529 plan assets on eligibility under particular financial aid programs. Please consult with an attorney or a tax or financial professional for additional information and/or guidance.