This should be a great time to be a mining investor.

After multi-year troughs for many metals markets, an epic bull market for commodities is currently in its infancy. Yet mining stocks – especially the junior mining stocks – are generally stuck in bear market trading patterns.

One notable exception to this trading is Electric Royalties Ltd. (TSXV:ELEC / OTC:ELECF) . More on this later.

Dismal mining share prices are another example of how dysfunctional our markets have become now that they are dominated by the Big Banks’ (mindless) trading algorithms.

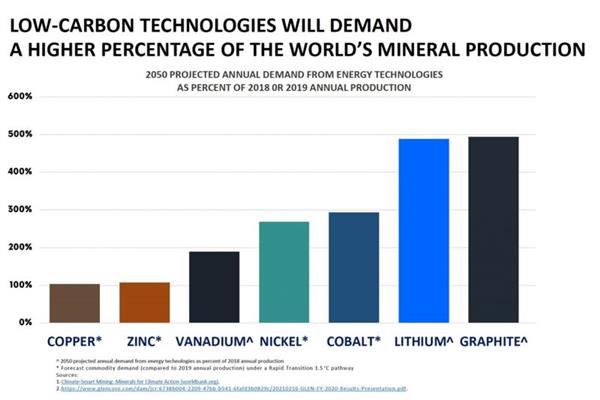

Yet the Commodities Bull is here to stay. In developed economies, the Clean Energy Revolution is almost like another Industrial Revolution.

Source: Electric Royalties Ltd.

Source: Electric Royalties Ltd.

Renewable energy sources are taking over for fossil fuel-driven power. Cleaner transportation is on the way.

This will require vast amounts of metals for all the new energy and transportation infrastructure. A lot more metals for the new vehicles, themselves.

In the Rest of the World, China’s Belt and Road Initiative (BRI), dubbed “the New Silk Road” is simply the largest mass-industrialization in History.

Roughly two-thirds of the world’s population (across Asia, Africa and parts of Europe) will be investing enormously in new transportation infrastructure, paralleled by the development of vast, new industries across these nations. Over 140 nations have signed up to participate.

As an added bonus for commodity producers, the U.S. Inflation Act is targeting billions in new spending for clean energy technology and related infrastructure. Even more demand for clean energy metals.

A major bull market for mining stocks is on the way. But when? What is the best way for investors to capitalize on this opportunity – today?

How about a mining royalty company whose focus is on clean energy metals?

Meet Electric Royalties Ltd. the world’s first-and-only publicly traded clean energy metals royalty company.

Strong stock performance since going public

A clean energy metals royalty company sounds like a good idea. Even our fickle markets seem to approve of this business model.

Most junior mining stock charts show depressing, downward sloping trajectories in recent years, reflecting the punishing market conditions. In contrast, the three mining stocks above have all generated gains for investors since ELEC commenced trading on June 29, 2020.

Two of those three strong performers are not merely premier large-cap royalty companies – they are icons in the Canadian mining industry. The third stock, and the best performer of the three (+17.8%), is Electric Royalties.

Electric Royalties Ltd. went public very early in the Covid pandemic. Not an ideal time for a public company to make its trading debut.

Yet while most other junior mining stocks have been ground steadily lower over these past three years, Electric Royalties is trading higher. Indeed, this junior mining royalty company has traded a lot more like a large-cap royalty company than a junior mining stock.

Mining royalty companies generally outperform other mining stocks. But even a junior mining royalty company?

Investors may want to look at ELEC’s strong leadership for clues to its solid stock performance.

Chief Executive Officer, Brendan Yurik was also Founder and CEO of Evenor Investments Ltd., described as “a financial advisory group to junior mining companies for alternative financing, debt, equity and M&A”.

Yurik’s resume includes experience with over $2 billion in mining financing transactions. The CEO also has previous mining experience as a research analyst and in business development. If you were grooming someone to run a mining royalty company, able to assess mining assets and successfully close transactions, this is pretty much the skill-set for which you would aim.

At the Board level, Chairman Marchand Snyman is also Co-founder and Chairman of RE Royalties Ltd, a renewable energy royalty company, which has participated in the acquisition of over 100 royalties to date.

With this sort of guidance and leadership at the top, Electric Royalties’ strong trading performance (versus most other mining stocks) becomes less surprising.

Two revenue-producing royalties and one near-term producer

Two of the royalties in Electric Royalties’ portfolio of 21 mining royalties are already in production (a 22nd royalty is still pending to close).

The Middle Tennessee Zinc Mine first went into production 45 years ago, but still offers additional exploration potential. Electric Royalties holds a sliding-scale Gross Revenue Royalty (GRR) for this Mine for zinc prices above USD$0.90 per pound (zinc is currently USD$1.31/lb).

Electric Royalties acquired this producing asset on March 10, 2021. In roughly two years, the GRR has generated revenues of CAD$590,000 for ELEC.

More recently, the Penouta Tin-Tantalum Mine (located in Spain) has just recently commenced commercial production. Europe’s largest tin/tantalum producer, Penouta announced production of 80.2 tonnes of primary concentrate in September 2022, alone.

On January 24, 2023, Electric Royalties acquired a 0.75% Gross Revenue Royalty (GRR) for this Mine, for a purchase price of CAD$1,000,000 and 500,000 common shares of ELEC. Electric Royalties also holds an option to increase this GRR by an additional 0.75%.

This new revenue stream will begin to bolster the Company’s coffers in future quarterly results.

Meanwhile, the Authier Lithium Project (operated by Sayona Mining) is expecting to begin shipping feedstock to Sayona’s nearby NAL mill later in 2023. Quebec is an emerging hub for hard-rock lithium mining.

A 2019 Feasibility Study defined a Measured & Indicated lithium resource at Authier of 17.18 million tonnes (grading at 1.01% Li2O). An additional Inferred resource contains an estimated 3.76 million tonnes of ore (at a grade of 0.98%).

Electric Royalties has made lithium assets a key focus of its royalty acquisition strategy, capitalizing on the huge run-up in the price of lithium. The Company holds royalties on seven lithium projects (including Authier).

Moving forward, management is now looking to increase diversity in its royalties portfolio. In addition to its producing assets, Electric Royalties currently views 9 of its 22 royalties as being “key” investment drivers.

Source: Electric Royalties Ltd.

Source: Electric Royalties Ltd.

In addition to its two-producing royalties and one near-term producer, Electric Royalties has identified several near-term catalysts for further growth.

This includes a new resource estimate for the Cancet Lithium Project, a Feasibility Study for the Mont Sorcier Vanadium Project, and a Pre-Feasibility Study on the Zonia Copper Project.

Additional royalty-related Project developments were highlighted in a February 1, 2023 corporate “update”. Electric Royalties has also announced a binding agreement with Tartisan Nickel Corp on March 6th to acquire a 0.5% GRR on its Kenbridge Nickel Project.

Hard (and durable) mining assets

A mining royalty – either a GRR or NSR (Net Smelter Royalty) – is more than a mere paper “interest” on some accounting ledger.

These are hard assets. With rare exceptions, these GRRs and NSRs are legal claims attached directly to the mining property itself. This is crucial for investors.

Many mining projects with clear commercial potential often go through several sets of hands between the time of initial exploration and the actual commissioning of a mine.

In the current (and previous) bear market conditions for mining stocks, even companies that have successfully advanced projects have often not been financially successful because of the dilution they incurred to develop these projects.

GRRs and NSRs are carried to production with no dilution. They are also hard assets with intrinsic value. Translation: low-risk mining assets, making mining royalty companies (relatively) low-risk investments.

A previously announced agreement (June 28, 2022) by Electric Royalties to sell two-thirds of its 1.5% NSR on the Seymour Lake Lithium Deposit for CAD$4,000,000 ultimately did not close between the two parties. But it provides investors with an indication of the potential cash value of these hard assets.

The fact that these mining royalties are both hard and durable assets is a primary reason why mining royalty companies tend to outperform their mining peers. Undiluted interests, carried to production.

In current market conditions, most junior mining companies and their investors are exposed to not just operational risk, but (now) also market risk. Can a mining junior advance a promising mining asset before brutal market conditions wipe out most/all shareholder gains via the dilution in financing that development?

This operational/market risk is in addition to the “risk” incurred by a mining company every time they acquire a new asset.

Then we have Electric Royalties, and mining royalty companies, in general.

Electric Royalties is not exposed to the operational/market risk noted above, since it’s not a project operator and does not need to finance project development.

The only “risk” (and dilution) in the Electric Royalties business model is in the acquisition of new royalties.

However, the premium share price that ELEC has traded at (versus other juniors) has allowed the Company to finance its acquisitions more efficiently (i.e. with less shareholder dilution). And, as already explained, mining royalties are inherently low-risk assets.

Why has Electric Royalties consistently outperformed most junior mining stocks since going public? Low risk, low risk, and low risk.

The perfect mining investment for today?

Dubbing any junior mining stock a “perfect” investment is setting the bar very high – especially in today’s markets. Let’s examine the Electric Royalties investment proposition.

- Very broad metals exposure.

- The investment strength and stability of a large-cap mining stock.

- The huge investment upside of a junior mining stock in the early stages of a major metals bull market.

Broad metals exposure:

Electric Royalties’ portfolio of 21mining royalties gives shareholders exposure to lithium, zinc, graphite, copper, manganese, vanadium, tin, tantalum, silver, nickel and cobalt.

And investors get this metals exposure in the form of low-risk NSRs and GRRs.

Investment strength and stability:

For most investors in junior mining stocks, investing in (and holding) these mining companies has produced a lot of sleepless nights in recent years due to market conditions. Not for shareholders of ELEC.

The Company’s 17.8% return since going public hasn’t gotten its shareholders rich. But while a lot of other junior mining companies have been battered by added dilution connected to these poor market conditions, ELEC is unscathed – and poised to fully capitalize when bull market conditions emerge.

Huge investment upside:

The appeal of junior mining stocks to investors is simple: as growth stocks, they offer much more long-term growth potential than more mature mining companies (with larger market caps).

Electric Royalties provides investors with very broad metals exposure, in the lowest-risk business model for a junior mining company, just as the global economy is cycling into a once-in-a-lifetime bull market for metals.

Many experienced mining investors look at Franco Nevada and Wheaton Precious Metals as “perfect” mining investments.

Electric Royalties has outperformed these iconic mining stocks, during brutal market conditions. That’s the sort of downside strength that will impress even the most skeptical mining investor.

However, unlike FNV and WPM, Electric Royalties’ mining royalties portfolio is just beginning to mature. This means that ELEC offers investors far more long-term growth potential than either of those premier mining large-caps.

High upside. Low downside risk. A unique investment vehicle strongly positioned to capitalize on a mega-bull market for metals.

If Electric Royalties is not a perfect mining investment for today, it’s certainly pretty close to it.

Disclaimer:

The Information contained here is a paid advertisement and is for information purposes only and is not to be construed as an offer or solicitation for the sale or purchase of securities. Prior to making any investment decision, it is recommended that readers consult directly with the public company and seek advice from a qualified investment advisor. The corporate information included in this was provided by Electric Royalties Ltd. in order to help investors learn more about their company. The information provided is purely and solely the responsibility of Electric Royalties Ltd. who has reviewed and approved all material for accuracy. Stockhouse does not provide investment advice and the information on this profile should not be considered a recommendation to buy or sell any security. Investing in securities is speculative and carries risk. Persons who wish to buy or sell securities should only do so at their own risk and in consultation with their registered securities advisers. Stockhouse does not own stock in Electric Royalties Ltd.