Key Takeaways from Kroll’s Restructuring Conference

Deal Sourcing and Fund Restructuring in an Uncertain Economic Environment

Private Credit

Private Credit

Banks who used to have proprietary trading and specialty financing desks before the global financial crisis were supposed to be replaced with private credit lenders willing to offer complex, dynamic credit solutions, but this has not panned out as expected. Private credit has tended toward larger sponsor-led deals and have neglected significant swaths of European mid-market businesses that needed financing.

Private lenders have stepped in to fill this gap. For a while, they were lauded as providing capital. Direct lenders are now reluctant to step in for mid-market businesses, as this has evolved into a more institutional style.

Attention has been focused on the health, professional services and technology sectors, which receive the bulk of lending. Large parts of Europe are underserviced because of a focus on these primary industries.

There is a difference between the current economic climate and that of 2008. 2008 was more of a shock, whereas now, there is a build-up of variables and distress in the market. Debt maturities over the next two years has more than doubled and will result in an increase in distress in the marketplace but also present opportunities for private credit funds to step into special situations and debt restructurings.

Real Estate

Real Estate

Higher borrowing rates and post-COVID-19 re-configurations have created a cliff-edge in the European real estate market. “The penny hasn’t dropped yet.” European banks seem to be willing to kick the can down the road and roll forward unsupportable LTV (loan to value) based on questionable valuations.

There is a wider issue around leverage. Interest rates have more than doubled in recent times, valuations have come down significantly and vacancy rates (particularly in office and commercial) have increased.

This is a poor combination of factors particularly in light of significant debt maturities over the next two years. Many borrowers will not be able to refinance in these conditions and will be forced to raise additional capital or take out mezzanine financing in order to extend debt maturities until the market recovers.

Challenges Confronting Funds

Challenges Confronting Funds

There have been a variety of factors resulting in an accumulation of issues in funds. Higher cost of capital has made credit more difficult to access, made refinancing difficult due to technical defaults for LTV breaches and coverage ratios, and put downward pressure on valuations. Equally, COVID-19 has impacted investment theses and portfolio companies have lost two years—resulting in some sticky investments as funds approach the end of their life. There has been an increase in enquiry on both the general partner (GP) and limited partner (LP) side for dealing with fund underperformance, mismanagement and end of fund life issues (i.e., lack of runway). Some common issues and themes are noted below.

The cost of managing a regulated fund and maintaining the infrastructure necessary in a regulated environment is no longer viable given a reduction in net asset value and by consequence fees. LPs and GPs are looking for more cost-effective structures to deal with tail-end issues. At times, the GP is facing regulator investigation or scrutiny and often a solution is to step aside and allow someone else to continue the fund. The investment thesis for underlying investments has failed, and the assets are distressed or require specialised skill sets to extract value. There is a concern regarding the management of the fund, lack of (or no) communication between the investment manager and LPs, including delays in audits and valuations.

We are seeing a much greater proliferation of “zombie funds” and, whilst coming to the end of lives, GPs and LPs interests diverge. The issue of moral hazard can arise, where sometimes GPs want a long run off to maximise management fees. Fund lives are now extending to around 17 years (as opposed to the standard 10-12 years) from opening to liquidation. There is no one solution to the issue of zombie funds, and there is also an increasing number of inquiries in this space. You can implement a structural solution (reducing cost base and lowering cost structures), or you can look for assets that haven’t matured to buy more time. In the U.S., there is a range of options and provisions that vary state-by-state. The use of Liquidating Trusts is common, which entails moving assets into a new vehicle, and decreasing the regulatory overhead. In the Cayman Islands, a fund can be rolled into a winddown, rationalising costs and providing runway to divest assets. Finding a structure that works for LPs and GPs is key.

Regarding LPs, the dissatisfaction with the Investment manager/GP is a concern. When this is the case, it is common for LPs to explore a replacement of the GP. The governing documents of a fund often provide LPs and GPs limited options. A change of the GP is possible, but often requires significant LP coordination. The key is to make sure the governing documents are as robust as possible and provide the tools necessary to effect change when needed. There are lot of ways in which funds can get involved, and lots of circumstances where GP and LP issues provide opportunities to buy good assets at distressed prices.

Through the Lens: A Look Ahead at the UK’s Most Challenging Sectors

When it comes to the issues facing business sectors in the UK, some factors are universal. Rising living costs, squeezes on discretionary spending and geopolitical instabilities are all having significant impacts. Whilst investor confidence is returning, consumers and businesses are still erring on the side of caution, and uncertain economic conditions and geopolitical tensions persist. However, each sector is also facing its own unique challenges.

Consumer and Retail

Consumer and Retail

Higher interest rates and persistent inflation are straining consumer finances, leading to reduced spending and more cost-conscious behavior. Businesses, particularly in the consumer-facing sectors, are grappling with liquidity challenges and difficulties in refinancing as access to low-interest rate loans (cheap money) dwindles. Consumers are becoming savvier in their choices, seeking maximum value whilst simultaneously being more environmentally conscious.

Notable shifts in consumer habits include a move away from alcohol towards non-alcoholic beverages, impacting on historical revenues, demographic behavioral changes, as seen with recent late-night venues closing. Pubs, bars and restaurants are having to change the way they operate. We will continue to see businesses in the hospitality space closing their doors in 2024.

Hybrid work models have resulted in a decline in footfall in city centers, with many restaurants, pubs and shops suffering from a significant decrease in customers. Retailers are adapting to online shopping habits by tightening return policies and increasing delivery charges to control costs. The impending increase in the National Living Wage will further strain businesses across all sectors.

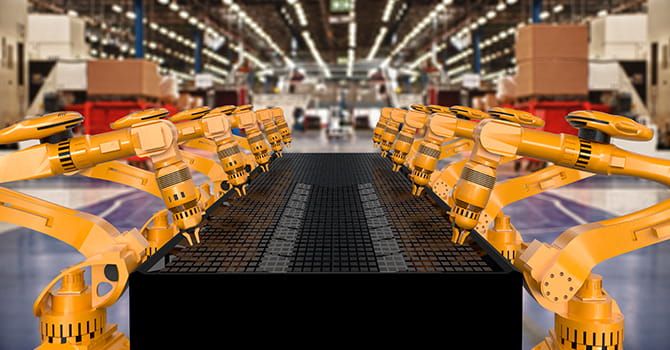

Manufacturing

Manufacturing

The sector also has to contend with an ageing workforce and a skills shortage, as apprenticeship numbers have declined significantly over the past decade. These challenges directly impact logistics providers, whose costs are driven by staffing, vehicles and warehousing.

The manufacturing sector faces volatility in demand, making forecasting and inventory management extremely challenging. Supply chain disruptions and extended lead times for key components, exacerbated by global events like the war in Ukraine and issues in the Red Sea, have made working capital management arduous.

There have even been restructuring cases when interested buyers have gone cold on a purchase due to a lack of “future proofing” with its ageing workforce.

Technology

Technology

While the technology sector has not been immune to the economic downturn, it benefits from the ongoing momentum behind digital transformation and automation. Slowing demand and higher interest rates have impacted growth and investor sentiment, with some early-stage businesses struggling to raise capital in a more difficult economic environment and when valuations have fallen significantly since their “Covid peak” in 2021. There has recently been a shift among technology businesses towards strengthening balance sheets, with greater focus on capital and efficiency in the short term. Compounded by higher operating costs, particularly wage inflation, business leaders have made difficult decisions, including widespread redundancies.

Nevertheless, as investor and business confidence returns, the sector is anticipating that there will be an general increase in investment on software, intellectual property and digital infrastructure to support value-creating activities. The rise of AI and machine learning, although perhaps “overhyped” in its ability to eliminate the need for a human workforce in the short term, has the potential to drive innovation and growth at a rapid pace. Like manufacturing, the technology sector faces a growing skills gap as employers struggle to keep up with the speed of change, particularly in areas like AI, data analytics, software development, cloud computing and cybersecurity.

Businesses across all sectors, and of all sizes, should be accelerating their digital transformation efforts given the power of technology to improve all aspects of performance. This should include leveraging AI to simplify processes, handle repetitive tasks, and improve supply chains and customer experience. There also needs to be continuing investment in digital infrastructure, such as data centers, and cybersecurity measures to store and protect the growing amount of sensitive data being created. We will inevitably see an increasing amount of regulatory scrutiny on AI, data privacy and cybersecurity, as threats to and risks surrounding the technological landscape become increasingly more sophisticated.

Restructuring

Financial and operational restructuring and enforcement of security, including investigation, preservation and realization of assets for investors, lenders and companies.

Real Estate Advisory Group

Leading provider of real estate valuation and consulting for investments and transactions.

Valuation Advisory Services

Our valuation experts provide valuation services for financial reporting, tax, investment and risk management purposes.