SUMMARY

With the Union Budget 2020, the focus will be on how finance minister Nirmala Sitharaman turns the economy around

The FM will have to temper expectations from the startup ecosystem with the rising balance deficit

Startups called for GST reforms, quicker disbursal from the Startup India fund corpus as well as dedicated seed and innovation funds

With each new year, there are plenty of expectations from the Narendra Modi government and the Union Budget 2020. While from 2014-2019, the focus of the government and successive finance ministers has been on boosting innovation and propping up the startup ecosystem, with the Union Budget 2020, it will shift to turning around the economy and beating the consumer spending decline, the flagging GDP growth and many ailing sectors such as auto, real estate, agriculture, energy and others.

Will this budget live up to the expectations of the industry?

This year, the government is likely to see a shortfall of INR 2.5 Lakh Cr in the tax revenue, and the government has yet again pushed the RBI for another dividend boost. Clearly, the finance minister Nirmala Sitharaman has very limited resources at hand, and this is likely to be highlighted in the parliament when the FM introduces the Union Budget 2020, which is just a few hours away now.

Explaining the current situation in the country, PM Narendra Modi’s former chief economic advisor, Arvind Subramanian wrote, “India is facing a great slowdown”, while former RBI governor Raghuram Rajan and Nobel laureate Abhijit Banerjee too have echoed similar concerns due to record ‘low consumer spending and rising balance deficit’. Clearly, Sitharaman has a plethora of issues to deal with.

Inc42 also took down the expectations for India’s leading investors and startup founders to highlight the key demands from the Union Budget 2020.

- Last Stand At The Bridge For Indian Economy

- Revenue Crisis, GDP, Private Investments: How will Union Budget 2020 fix India’s macroeconomic issues?

- Healthtech: Will Sitharaman Make Healthtech More Accessible, Affordable for Indians?

- Electic Vehicles: From Lowering Gst on Li-ion Batteries to Debt Financing, the Ev Sector Needs Hand Holding

- Fintech: Startups Demand Clarity On Zero MDR

- Tax Reforms: Will India Get Major Tax Reforms To Address Economic Slowdown?

- Investors Urge For Tax Parity On Capital Gains, Faster Funds Disbursal

- Ecommerce: Stakeholders Demand Fair Policy Implementation And Tax Parity Between Offline And Online Suppliers

- Agritech: Remove Middlemen Incentives, Increase Dbt To Farmers And An Innovation Fund, Demand Startups

- Edtech Startups Call For A Bigger Focus On R&D From Sitharaman’s Budget 2020

Based on our conversations, we have compiled the wishlist from the startup and investor ecosystem. Here’s a look:

Union Budget 2020 Live Updates

So which of these demands will be at top of Sitharaman’s priority list in the bahi khata? Find out as Inc42 covers the Union Budget 2020 with minute-by-minute.

Budget To Bring Down Litigation In Direct Taxes But What About Angel Tax ?

Nirmala Sitharaman: A scheme to bring down litigation in direct taxation scheme. To introduce a scheme to bring down litigation in direct taxation scheme; 4.83 Lakh direct cases pending in various appellate forums.

Inc42 Take: This will help the startups and companies stuck in long term tax debates or legal cases. Although, considering the nature of Indian courts and appellate forums, any scheme introduced will take a considerable time to become a mainframe process. Not keeping hopes so high, patience will be the key here for Indian startup ecosystem.

However, this does not clarify the angel tax issue for startups more than before. Startups would look for more support from the finance ministry in this regard.

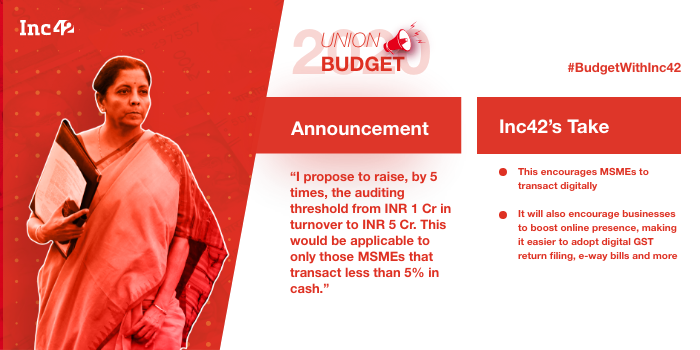

MSME Compliance Burden Reduced

Nirmala Sitharaman: In order to reduce the compliance burden on small retailers, traders and MSME sector, I propose to raise by 5 times the auditing threshold from INR 1 Cr in turnover to INR 5 Cr. This would be applicable to only those MSMEs that transact less than 5% in cash.

Inc42 Take: As per the MSME ministry, the sector employs about 106 Mn Indians or 40% of India’s workforce, next only to the agricultural sector. SME output is estimated to be 45% of the total Indian manufacturing output, while SME exports make up 40% of India’s total exports. Further, the sector accounts for 16% of bank lending business.

In a statement shared with Inc42, Prime Venture Partners’ cofounder Sanjay Swamy had earlier demanded that to boost the digitisation, digital payments must be made mandatory. By raising auditing threshold five times, from INR 1 Cr to INR 5 Cr for MSMEs who transact over 95% via digital payments, the government might just encourage MSMEs to go digital.

This will also help encourage businesses to boost online presence, making it easier to adopt digital GST return filing, e-way bills and improve efficiency in logistics and manufacturing.

Startups Get Tax Breaks, ESOP Tax Deferred By 5 Years

Nirmala Sitharaman: Proposes to ease the tax burden of ESOP on employees by deferring the tax payment by 5 years or till they leave the company or when they sell their shares, whichever is earliest.

An eligible startup with a turnover of upto INR 25 Cr is allowed a deduction of 100% of its profits for 3 consecutive assessment years out of 7 years. In order to extend this benefit to larger startups, we propose to increase the upper limit of revenue to INR 100 Cr.

Moreover, I propose to extend the period of eligibility of deduction from 7 years to 10 years.

Inc42 Take: ESOPs have become instrumental in Indian corporate and startup ecosystem to woo high-value employees and retain talent. The likes of Razorpay, Oyo, Flipkart, Moglix, BharatPe have already announced their ESOP plans and even the buybacks. Exemption of taxes on ESOPs will further encourage companies to introduce ESOPs in their companies at a large level, which in turn will allow them to attract world-class talent while keeping employee costs in check.

According to DataLabs by Inc42, the median amount of funding rounds in Indian startups recorded a CAGR (Compounded Annual Growth Rate) of 36% between 2014 to 2019.

In June 2019, the Department for Promotion of Industry and Internal Trade (DPIIT) started discussions with the country’s finance ministry to tax Employee Stock Ownership Plan (ESOP) options only once at the time of sale.

In July 2019, LetsVenture launched a campaign to build a standardised framework for startups’ ESOPs. LetsVenture’s campaign aimed to identify ESOP best practices and later make its learnings open source for startups and entrepreneurs to implement.

Foreign Sovereign Funds Get Tax Breaks

Nirmala Sitharaman: 100% tax exemption to the interest, dividend and capital gains income on investment made in infrastructure and priority sectors before 31st March, 2024 with a minimum lock-in period of 3 years by the Sovereign Wealth Fund of foreign governments.

Amendments to Dividend Distribution Tax (DDT):

- DDT removed making India a more attractive investment destination

- Deduction to be allowed for dividend received by holding company from its subsidiary

- INR 25K Cr of estimated annual revenue forgone

Inc42 Take: Sovereign funds have been an important funding source for startups in India. Funds like Canada Pension Plan Investment Board and GIC participated in a $145.8 Mn buyout of a school operator Oakridge International School in 2019. Sovereign funds such as the Qatar Investment Authority, Mubadala and the Norway Sovereign Fund are also active in the Indian startup ecosystem. The move will further attract foreign funding.

Personal Income Tax Rate Slashed

| Income Bracket | Tax (2020-2021) | Tax (2019-2020) |

|---|---|---|

| <2.5 Lakh | 0% | 0% |

| 2.5-5 Lakh | 5% | 5% |

| 5-7.5 Lakh | 10% | 20% |

| 7.5-10 Lakh | 15% | 20% |

| 10-12.5 Lakh | 20% | 30% |

| 12.5-15 Lakh | 25% | 30% |

| Above 15 Lakh | 30% | 30% |

Nirmala Sitharaman: Income tax is riddled with various exemptions and deductions, which makes compliance and assessment burdensome. In order to provide significant relief, I propose to bring a new simplified personal income tax regime.

Under the new simplified personal income tax regime, an individual shall be required to pay 10% tax on INR 5 Lakh – INR 7.5 Lakh from the current 20%. For income between INR 7.5 Lakh to INR 10 Lakh, the reduced rate is 15%, against 20% currently. For INR 10 Lakh – INR 12.5 Lakh, the tax goes from 30% to 20%. For INR 12.5 Lakh to INR 15 Lakh, will be charged at 25%. There will be no changes in the income tax for income over INR 15 Lakh, which will be charged at 30%. Individuals earning under INR 5 Lakh will not have to pay any taxes. For an individual earning INR 15 Lakh with no deductions, the tax will now be INR 1.95 Lakh vs INR 2.73 Lakh.

Around 70 deductions and exemptions have been removed in the simplified tax regime.

Inc42 Take: According to the income tax department, 6.68 Cr income tax e-filings were recorded in FY 2018-19, down from 6.74 Cr in the previous fiscal. The number of e-filers in FY 2016-17 was 5.28 Cr. However, registered filers have been on the rise – they grew by 15% to 8.45 Cr as on March 31, 2019.

This partly addresses the concerns raised by many experts and industry observers in our budget preview articles. People were expecting a tilt towards demand-side policies and hence an increase in the basic exemption limit of INR 2.5 Lakh for individuals and increase in the income limit at which the maximum marginal rate of 30% kicks in.

New slab introductions and an increase in the income limit for the existing slabs will immensely help address the low consumer spending and boost savings in banks.

Fiscal Deficit Goal Post Moved Further

Nirmala Sitharaman: Fiscal deficit for FY 2021 estimated at 3.8%. For FY 19 the government said fiscal deficit was estimated at 3.5%.

Inc42 Take: In Jan 2019, the government had budgeted for a fiscal deficit of IN 6.24 lakh crore, or 3.3% of the GDP, for FY19.

Corporate Bonds To Now Allow For Higher Foreign Investments

Nirmala Sitharaman: Our government proposes to increase FPI in corporate bonds to 15% from 9%.

Inc42 Take: In 2019, the total FPI (Forgein Portfolio Investment) in India stood at INR 84.5K Cr. This has been the highest inflow of FPI since 2014. Given the fact that FPIs are invested with an intention of long term income gain by the institutional investors, increasing FPI will reduce the risk of capital uncertainty in the market.

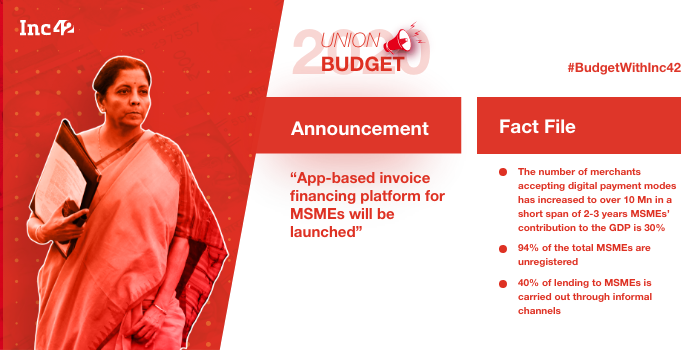

App-Based Invoicing Platform For MSMEs To Ease Compliance

Nirmala Sitharaman: App-based invoice financing platform for MSMEs will be launched.

Inc42 Take: The number of merchants accepting digital payments modes has increased to over 10 Mn in a short span of two to three years. The global digital payments market is expected to touch $10.07 Tn by 2026.

The Reserve Bank of India had forecast an outcome of 50% increase in mobile-based payment transactions as per its ‘2021 vision document’. This shift can be attributed to driving factors such as robust payment infrastructure, evolution of form factors, availability of structured data, shift in consumer behaviour and the government’s vision of transforming India into a cashless economy.

In such a scenario, digitised invoice financing is a crucial move. Introduction of technologies like blockchain, AI and ML at the backend, can reduce load of compliance for MSMEs.

For the novice, invoice financing is a way for businesses to borrow money against the amounts due from customers. Invoice financing helps businesses improve cash flow, pay employees and suppliers, and reinvest in operations and growth earlier than they could if they had to wait until their customers paid their balances in full. Startups like Lendingkart, Indiffi, Izito are already operational in this segment.

As per a report by Omidyar Network and BCG, 40% of lending to MSMEs is carried out through informal channels, which goes on to show that lending is a big opportunity for fintech startups. As per DataLabs by Inc42, fintech startups in India raised a total of over $9.7 Bn in the period between 2014 to 2019.

A Clean & Robust Financial Sector

Nirmala Sitharaman: A clean and robust financial sector is critical for the economy. The financial architecture needs to be evolved in order to achieve $5 Tn economy target.

In previous years, the Indian government has infused about INR 3.50 Lakh Cr in the public sector banks for both regulatory and growth purposes.

I would like to assure the house that robust mechanisms have been put in place to check the financial health of all scheduled commercial banks. Depositors money is absolutely safe. Insurance cover for depositor money increased from INR 1 Lakh to INR 5 Lakh.

There is a need for greater private capital.

Inc42 Take: “There is a need for greater private capital,” undeniably true. However, transparency in the economy can’t be brought without bringing transparency in electoral bonds. Further, the government has also suspended revenue deficit targets. And infusing INR 3.5 Lakh Cr in public sector banks has not addressed the needs of the NBFCs and the Indian economy at large, as expected.

While UPI and RuPay have gone global, there is more to be done in India’s financial services sector in terms of fixing accountability and bringing transparency to the system. For instance, who shall be held accountable for failed UPI transactions, even if the percentage is extremely low.

In 2019-20, the centre’s fiscal deficit was budgeted at INR 7.04 Lakh Cr (3.3% of GDP), as compared to INR 6.49 Lakh Cr (3.4% of GDP) in 2018-19. In the first eight months of 2019-20, the fiscal deficit stood at 114.8% of the budgeted level.

On the supply side, the deceleration in GDP growth has been contributed generally by all sectors save ‘agriculture and allied activities’ and ‘public administration, defence, and other services’, whose growth in H1 of 2019-20 was higher than in H2 of 2018-19

On the demand side, the deceleration in GDP growth was caused by a decline in the growth of real fixed investment in H1 of 2019-20 when compared to 2018-19 induced in part by a sluggish growth of real consumption.

In The Face Of Record Unemployment, Govt To Setup Recruitment Agencies

Nirmala Sitharaman: Our government proposes to set up a National Recruitment Agency as a specialist of common eligibility test for recruitment to the non-gazetted posts across the country in the aspiration districts.

Inc42 Take: This step will create an opportunity for the blue-collar workforce to come into the light and get better job options. Even the private sector companies and HRTech startups can make use of this agency to fill in the existing gaps in various industries.

The problem with employment in India is also one closely linked to lack of skills. According to a Aspiring Minds study, 38% of the Indian IT job applicants were unable to write a single compilable code. In this space edtech companies like Pesto, UpGrad, InterviewBit are working to reskill Indian tech workers.

New Taxpayers’ Charter Will Not Tolerate Tax Harassment

Nirmala Sitharaman: The government reinforces commitment to eliminate tax harassment. Will enshrine taxpayers charter to boost confidence, the finance minister said. The government will also decriminalise some norm violations under Companies Act. Companies Act to be amended to build into statues, criminal liability for certain acts that are civil in nature.

Inc42 Take: The proposed Taxpayers Charter would significantly reduce the degree of red tape culture in this domain. As per the data released by the IT department, total tax applications filed in 2018-19 was 58.7 Mn with a gross recorded income worth INR 51.3 Lakh Cr. In 2018, a 40% decline was observed in early-stage deals compared to previous year due to uncertainty over angel tax norms that year.

Clean Air On The Agenda

Nirmala Sitharaman: We are committed to preserving the environment and tackling climate change. Government proposes to encourage such states that are working to ensure cleaner air. Parameters for incentives will be notified soon. Allocation for this is INR 4,400 Cr for 2020-21. Our aim is to reduce carbon footprints by phasing out old thermal plants. The message to old plants is ‘Emit More, Shut Down’.

Inc42 Take: While India claimed to meet the targets of Paris Climate Summit 2015, India’s overall ranking on the Global Climate Risk Index 2020 slipped nine points from 14th in 2017 to the fifth in 2018. The recent UN climate report on India too maintained that India only aimed for the low hanging fruits and should actually revise its targets accordingly.

This is at a time when 22 out of the 30 most polluted cities in the world are based in India. There needs to be a collaborative effort between the states and the central government. Clearly, a lot needs to be done, and there is no shame in following China’s commendable work in Shanghai, once the world’s most polluted city.

India is estimated to lose INR 2.7 Lakh Cr or 0.36% per unit of its gross domestic product due to climate change, a report published by the Bonn-based think-tank Germanwatch.

Higher Enrolment Of Girls At All Levels Of Education

Nirmala Sitharaman: The government is planning to focus on women, child, social welfare and climate change as well. Beti Bachao, Beti Padhao has yielded gross enrollment for girls across all levels of education is higher than boys. For instance, at the elementary level, 94.32% of girls are enrolled against 89.28% for boys and in higher secondary level, it is 59.70% for girls and 57.54% for boys.

Focussing on the health, wellness of mother and child, the government previously launched national nutritional quotient, Poshan Abhiyaan. Under the programme, more than 6 Lakh Aanganwadi workers are equipped with smartphones to upload nutritional data for 10 Cr households. The government plans to provide INR 35,600 Cr in nutrition related programmes for 2020-2012.

Overall, INR 35,600 Cr will be allocated to nutritional-related programmes and INR 28,600 Cr for women-specific programmes. We want to ensure the end of manual cleaning. Suitable technologies have been identified by ministry of housing and urban affairs.

Inc42 Take: Beti Bachao, Beti Padhao has been a dud, as RTI later revealed that 56% of the budget for the programme was actually implemented only on publicity. The subject matter highlights the harsh reality of India’s society and therefore should be dealt with more sincerity.

This is also to be noted that on Beti Bachao, Beti Padhao, the government of the day will have to walk the talk as many of its elected members have been accused of rapes, molestation.

National Level Science Scheme Introduced

Nirmala Sitharaman: For designing, fabrication and validation of proof of concept and further scaling of technology clusters, the government will harbour test beds and small scale manufacturing units. Mapping of India’s genetic structure is vital for next-generation medical, healthcare innovation and biodiversity management. To support this, the government plans national-level science schemes to create a comprehensive database. The government will also provide seed funds to support ideation and development of early-stage tech startups in the area of quantum computing.

Quantum technologies are offering a lot of commercial applications. Outlay of INR 8K Cr over a period of five years for the national mission of quantum technologies and applications. India will be the third-biggest and pionering nation if we are able to break in to quantum and other computing technologies.

Inc42 Take: This is really a welcome step by the government. However, more clarity is needed pertaining to the promises of the seed fund. The Modi government in its election manifesto had announced plans to create a INR 20K Cr Seed Fund.

Though there have been comprehensive databases available for clinical analysis, such a step from the government will further help localise the data and make it more contextual and effective for the concerned stakeholders.

Intellectual Property Laws Receive Mention in Budget 2020

Nirmala Sitharaman: A digital platform will be promoted to capture IPR and a centre will be established to work on the intellectual property rights of Indian enterprises.

Inc42 Take: India has the third-largest startup ecosystem in the world – a direct result of stronger Intellectual Property (IP) laws to promote, secure, and incentivise innovation. IP laws, a crucial tool to encourage economic growth and individual effort, are a set of rules that provide legal protection to an investor and inventor’s labour alike. One of the major areas that businesses need to stay aware of is Intellectual Property Rights.

The government has taken several steps that have led to an improvement in patent filing, as well as for safeguarding the Intellectual Property Rights (IPR). This includes streamlining the processing of IP applications, simplifying IP procedures and making them user friendly by amendment to the Patents Rules in 2016 and Trademarks Rules in 2017. Overall in 2017-18 filing of applications for various Intellectual Property rights (3,50,546) has been almost the same as compared to the previous year (3,50,467).

“As things stand, the government is inching toward building a holistic environment wherein originality is rewarded. However, there is still a long way to go before India becomes a nexus for robust IP mechanisms driving innovations,” says Dinesh Jotwani, advocate, Supreme Court of India.

INR 6K Cr For BharatNet

Nirmala Sitharaman: Our government proposes to allot INR 6K Cr for BharatNet.

Inc42 Take:Under the BharatNet programme, the government is aiming to connect more than 250K gram panchayats or village blocks with optic fibre network across India. This mission plans to provide high-speed broadband across all the rural regions, approximately 142K villages across India by 2022.

Besides the private, state-led and public-private partnership models being used for BharatNet-II, the government plans to implement a satellite model for many remote areas of the country, including the likes of Northeast India, Himachal Pradesh, J&K, Uttarakhand, Lakshadweep, Andaman & Nicobar Islands. As of November 29, 2019, over 388K Km of optical fibre cable has been laid by the government in over 142K villages.

New Age Technologies To Push Future Growth, Says Nirmala Sitharaman

Nirmala Sitharaman: We propose a policy to enable setting up of data centre parks across the country. It will skillfully incorporate data in every step of the data chain. Aanganwadi, panchayat, police station, and everything else will be provided access to this.

Inc42 Take: As of May 2018, 9.87 Mn farmers and 109.7K traders are said to have registered on the e-NAM (National Agriculture Market) platform. Not only farmers, NBFCs and SME lending players are now reaching deepest corners of the country, helping businesses to thrive.

A large part of this growth has been contributed by the use of deeptech like artificial intelligence (AI), machine learning (ML) and data analytics. Players such as Aye Finance, NeoGrowth, LendingKart among others are not only reducing NPAs consistently but are also able to raise funds amid the ongoing NBFC crisis, indicating a greater investor trust in fintech startups.

The infusion of technology in processes like credit assessment, underwriting, collections, and other areas of reaching out to the consumer and offering a valuable experience is encouraging people to adopt the new age banking, investment and credit platforms, leaving the traditional middle man approach. Push for new technologies is certainly the need of the hour.

550 Public WiFi Project For Railways

Nirmala Sitharaman: 550 public WiFi projects for railways in the first 100 days of the new government. The government aims to achieve electrification of 11K Km railway tracks, this will call for optimisation of cost for which it introduced few proposals.

The government is considering setting up large solar power capacity alongside rail tracks on land owned by Railways. The government is also planning to take up four station redevelopment projects under PPP. More Tejas-type trains will connect iconic destinations. The government will actively pursue a high-speed train between Mumbai and Ahmedabad. Bengaluru transportation project to revamp infrastructure in India’s startup capital. 100 new airports to be set up to support Krishi Udan and other logistics schemes.

Inc42 Take: A lot of big announcements including smart city project, industrial corridor projects have been announced in PPP mode in the past and have badly failed to meet their target. Some other smaller initiatives such as the installation of WiFi at railway stations saw a better implementation with Google and other players joining the project.

Similar is the case with Tejas project, the model is yet to be evaluated on a larger scale. However, this creates a huge opportunity for private players including startups.

The logistics sector in India is growing at a CAGR of 10.5% annually and is expected to reach $215 Bn in 2020 driven by infrastructure, regulatory boost and deeptech leverage.

INR 100 Cr To Be Invested In Infra

Nirmala Sitharaman: INR 100 Lakh Cr will be invested in infrastructure development. The National Infrastructure Pipeline was launched in December 2019 in this regard. It consists of 103 Lakh projects across industries. These new projects will impact housing, safe drinking water, clean energy, access to electricity, healthcare, world-class education, transportation, warehousing, modern railway stations, logistics and more.

Inc42 Take: The FDI in the construction development sector (townships, housing, built-up infrastructure and construction development projects) from April 2000 to June 2019 stood at $ 25.12 Bn. Despite having repeated announcements and funding allocation towards infrastructure development in the past couple of years, what we need to really look at is the continuity of the infrastructure projects. As for instance amid funding dearth, last year in August, the PMO had written to the ministry of road transport to stop building roads and look for the private investments as the projects have become financially unviable.

Hope, the infrastructure announcements will follow better planning in conjugation with the private sector.

2000 Km Of Strategic Highways To Be Built, Says FM

Nirmala Sitharaman: Our government will create 2000 Km of strategic highways.

Inc42 Take: In Union Budget 2018-19, the Government of India had given a massive push to the infrastructure sector by allocating INR 5.97 Lakh Cr ($92.22 Bn) to the sector. With logistics being the centre of growth of all sectors like manufacturing, agriculture, ecommerce particularly, this will be a huge boost for the startups in these sectors.

More Funds To Kickstart Industrial Production Announced

Nirmala Sitharaman: I propose to allot INR 27.3K Cr for development of industry and commerce for 2020-21.

New scheme Niryat Rin Vikas Yojana (NIRVIK) to be launched to achieve higher export credit disbursement, which provides for:

- Higher insurance coverage

- Reduction in premium for small exporters

- Simplified procedure for claim settlements

- Turnover of Government e-Marketplace (GeM) proposed to be taken to INR 3 Lakh Cr

- Scheme for Revision of duties and taxes on exported products to be launched

Inc42 Take: The economy has been facing certain issues on several fronts—demand, consumption and production. There have been concerns regarding consistent dip in GDP growth. The economy which was projected to grow at more than 7% is now expected to grow at 5%. The Reserve Bank of India has also acknowledged the slow GDP growth and has lowered its growth targets, says Harsh Jain, Co-founder and COO, Groww.

The deployment of funds to industry and commerce development will certainly ease the concerns of entrepreneurs like Jain. This will also help Indian businesses to push for global markets in a better manner, thereby opening doors for international conglomerates to the Indian market. A win-win for all, if only the funds are spent well.

Digital Refund For Duties By Exporters

Nirmala Sitharaman: Our government will enable digital refund for duties by exporters.

Background: As per government estimates, India’s overall exports (Merchandise and Services combined) in April-June 2019-20 are estimated to be $137.26 Bn, which is a growth of 3.14% as compared to the same period last year.

5 New Smart Cities

Nirmala Sitharaman: Our government proposes to create five new smart cities.

Background: Launched in 2015 by Prime Minister Narendra Modi, Smart Cities Mission is a programme which aims to develop 100 urban cities into smart cities across the country by making them citizen-friendly and sustainable. So far, the government has approved tenders amounting to over INR 1,62,000 Cr under this programme.

Besides the government authorities, private companies such as Tech Mahindra and Amazon are also proactively working in this programme. In December 2019, Tech Mahindra had bagged an INR 500 Cr under Smart City project for developing Pimpri Chinchwad Municipal Corporation (PCMC), a township adjacent to Pune, under the Smart Cities Mission.

On the other hand, Amazon’s cloud computing arm Amazon Web Services (AWS) has worked with the government to build India Urban Observatory, which is running on AWS. The India Urban Observatory helps the government to store data, related to Smart Cities Mission, collected in real-time as well as from archival sources under one roof.

Promoting Manufacturing Of Mobile Manufacturing, Electronics

Nirmala Sitharaman: Our government will promote the manufacturing of electronics by setting up a new scheme that incentivises mobile manufacturing, electronic equipment and semiconductor packaging.

Inc42 Take: India’s electronics market is one of the largest in the world in terms of consumption, and is predicted to grow to approximately $400 Bn by 2020 from $69.6 Bn in 2012. While in 2013-14, 65% of the demand for electronic products was met through imports, the electronics hardware manufacturing industry in India is projected to produce electronic goods worth $104 Bn by 2020 from $32.462 Bn in 2013–14.

To promote overall growth and open job opportunities, projected to attract investments worth $100 Bn, the Indian central government has sought to reduce the country’s electronics import bill from 65% in 2014–15 to 50% in 2016 and gradually to a net-zero electronics trade by 2020. India has pursued a two-pronged strategy of import substitution and export encouragement, through the Make in India campaign coupled with the Digital India campaign, along with the Startup India and the Skill India campaigns.

According to a research by GfK (Growth From Knowledge), Indians spent over $28.5 Bn towards buying smartphones in 2018.

Entrepreneurship Benefits Announced!

Nirmala Sitharaman: Entrepreneurship has always been the strength of India. We recognise knowledge skills and risk-taking capabilities of youth. They are not job seekers, but job creators.

Our government proposes to create an Investment Clearance Cell, which will provide end-to-end support including facilitating clearances on centre and state level.

Inc42 Take: According to the India Economic Survey 2020, a 10% increase in registration of new firms per district, yields a 1.8% increase in GDP (Gross Domestic District Product). In 2019, the Indian startups witnessed a total capital inflow of $12.7 Bn across 766 funding deals, as per DataLabs by Inc42.

According to NASSCOM, India is the third-largest startup hub based on the number of startups, while Israel is looking to compete with the country and claims the third position. Interestingly, the annual funding report by Inc42 DataLabs showed that India has been witnessing a decline in funding deals and amount. While this can be considered a negative sentiment in terms of numbers, this also shows how the young entrepreneurs of India are enthusiastically looking to build a bootstrapped business, and build sustainable revenue businesses.

The introduction of Investment Clearance Cell, will certainly help startups which are part of the DPIIT list. But ways must be identified to make more startups DPIIT recognised. At present, only 1,862 startups are DPIIT recognised (as of June 2019), out of the 39K startups in India.

A Special bridge Course For Skilling Healthcare Workforce

Nirmala Sitharaman: Government will create a special bridge course to bring in equivalence in training, language requirements and skilling the Indian healthcare workforce such as paramedical staff, nurses and caregivers.

Inc42 Take: This could indeed address the talent dearth in healthcare to some extent. The need-of-the-hour is however bringing in the healthtech startups also into the loop. Many of the healthtech startups are currently spending a huge part of their budget on training and skilling their room attendant and nurses, particularly for the home healthcare needs.

A Online Educational Programme To Be Set

Nirmala Sitharaman: INR 99,300 Cr allocated for the education sector in the 2020-21 budget. The government plans to set up an online educational programme to provide quality education to students from the deprived sections of the society and those who don’t have access to higher education. The programme will be provided by Top 100 institutions in India. Initially only a few institutions will be asked to provide this programme. National Police University, National Forensic Science University will be set up for policing, cyber forensic and forensic sciences. India should be a prefered destination for higher education. IND-SAT programme set up for higher education.

- 150 higher educational institutions to start apprenticeship embedded degree/diploma courses by March 2021

- External Commercial Borrowings and FDI to be enabled for education sector

Inc42 Take: India’s edtech sector recorded a 50% surge in unique investor participation in 2019 compared to the previous year. But the focus has largely been on school education and test prep. The share of funding amount in skill development to the total funding pool (2014-2019) was just 4% ($64 Mn). The investor focus has to fall on skill development for many of the government’s plans to bear fruit, especially when it comes to the technology sector and the digital economy.

T1 Year Internship Opportunities For Engineering Graduates

Nirmala Sitharaman: The government proposes a plan where urban local bodies will provide one-year internship opportunities to engineering graduates to help them plan better and learn, and contribute to development.

Swachh Bharat Funding Give Thumbs Up To Cleantech Startups

Nirmala Sitharaman: The allocation for Swachh Bharat this year is INR 12.3K Cr. The focus will be on solid waste collection and waste segregation.

Inc42 Take: India’s Swachh Bharat sanitation scheme is said to have reached 96.5% of the country’s rural population. Annually, India is reported to produce approximately 42 Mn tonnes of municipal solid waste.

The way technology is sweeping in the common man’s daily activities, we expect the Indian startup ecosystem will devise some methods to this major problem as well, thereby adding a boost to Swachh Bharat Mission To control the massive pollution levels, the startups are already working on cleantech, EVs, building smart cities and using solar and hydro energies for fulfilling resource needs of the nation avoiding fossil fuel usage. Impact investors and startups are also working to provide garbage collection, last mile connectivity, and eco-friendly housing. The last year’s budget allocation to Swachh Bharat Mission was INR 15.3K Cr, as compared to this year’s INR 12.3K Cr allocation.

TB Haarega, Desh Jeetega: Healthcare Receives A Boost

Nirmala Sitharaman: “TB Haarega, Desh Jeetega ” campaign has been launched. We strengthen this campaign to realise our commitment to end TB by 2025. Propose to expand Jan Aushodhi Kendras to all districts offering 100 medicines and 300 surgical instruments by 2024.

Inc42 Take: As per a 2017 World Bank report, India’s female life expectancy is 70 years, which is 5% lower than the world average of 74 years.

The Indian healthtech startup ecosystem has been instrumental in introducing a number of new technologies to improve the current state of healthcare in terms of access and affordability. Where government schemes like Ayushman Bharat have made it possible to make healthcare reach to the lower-income group, healthtech startups like NIRAMAI, OncoStem, and Tricog have been doing deep research pitching in cures and remote assessment for deadlier diseases. With the government’s impetus on reducing the TB patients growth in the country, we can expect the healthtech startup ecosystem to take this as an opportunity to introduce more tech-based solutions here.

According to DataLabs by Inc42, total funding raised by unique healthtech startups in India between 2014 and 2019 is estimated to be over $2 Bn.

Hospitals To Be Set Through Private Public Partnerships

Nirmala Sitharaman: We have a holistic vision for healthcare. INR 69K cr allocated to healthcare sector. PM Jan Arogya Yojana has 20K empanelled hospitals in Tier 2 and Tier 3 cities for poor people to benefit from them. Viability gap funding window will be established for setting up hospitals through private-public partnerships. In the first phase, 112 aspirational districts will be targetted for this development for Ayushman Bharat.

Agricultural Credit Limit For 2020 Set Up At INR 15 Lakh Cr.

Nirmala Sitharaman: NBFC and cooperatives active on social space, NABARD refinance scheme will be further expanded. The agricultural credit limit for 2020 set up at INR 15 Lakh Cr.

Inc42 Take: The 68 Mn grassroots businesses in India which have been making a significant contribution to National GDP, need support from the government. Policies need to focus on creating a supportive ecosystem which empowers micro enterprises to create globally competitive products rather than granting loan waivers which only leads to dependency and inadequacy in the sector.

While a lot of work has been done by SIDBI & RBI, we need more efforts in this direction to develop a more sustainable and robust sector.” says Sanjay Sharma – founder and managing director, Aye Finance. The expansion of NABARD scheme will certainly help the entrepreneurs like Sharma to now visonise their growth towards Bharat 2.0, the massive set of Indians coming online for the first time and adopting novel fintech products to run their personal finances and avail credit.

Gross value added by agriculture and allied sector to Indian GDP in FY19 stood at $265 Bn. Increasing agriculture credit limit is another good move. This will help agri-fintech startups like Farmart as well as several agri-lending NBFCs to reach out more farmers this year. However, a good and timely collection methodology added to this credit facility could be more fruitful in the long run, considering the NPAs suffered by banks and NBFCs on agri loans.

Cluster Model To Be Set For Horticulture Sector

Nirmala Sitharaman: “Horticulture sector with its current total production of 311.71 Mn metric tonnes, exceeds the production of the food grain. For better marketing and export, we propose supporting states by adopting a cluster model and focus on—one product, one district. Online national organic products market will also be strengthened through a dedicated marketplace platform.

Inc42 Take: As per government estimates, over the last decade, the horticulture industry grew by 2.6% per year and annual production increased by 4.8%. During 2017-18, the production of horticulture crops was 311.71 Mn metric tonnes from an area of 25.43 Mn hectares.

NABARD To Geo-Tag Warehouses

Nirmala Sitharaman: NABARD will geo-tag existing warehouses. We propose creating warehousing under the authority norms. Our government will provide viability gap funding for setting up such warehousing on block and taluk level.

Inc42 Take: Every year, more than 40% of food produced is wasted between all levels of the supply chain from the farm to the consumer. Many agritech startups have been working to use technology at various levels of supply chain to reduce this wastage. Same goes for other sectors be it manufacturing or ecommerce, where warehousing plays a major role in sustaining businesses and introducing good delivery speeds. Total requirement of storage space in the Indian manufacturing sector accounts for 80% of the warehousing market today.

Total warehousing space in India is estimated to be 68 Mn sq m (739 Mn sq ft) in 2019. As per real estate agency Knight Frank, with increasing real estate prices, this can be said to be an appreciable move from the government.

Moving Towards Solar For Farmers

Nirmala Sitharaman: We shall help 15 Lakh farmers solarise their grid-connected pump sets. In addition, a scheme to enable farmers to set up solar power generation capacity on barren land will be operationalised.

Under the PM-KUSUM scheme:

- 20 Lakh farmers to be provided for setting up stand-alone solar pumps.

- Another 15 Lakh farmers to be helped to solarise their grid-connected pump sets.

- Scheme to enable farmers to set up solar power generation capacity on their fallow/barren lands and to sell it to the grid.

Inc42 Take: Concerned from the issues arising from climate change, the startup ecosystem has started to shift its focus to sustainable economy and cleantech. Many companies like Zoho, Paytm among others are actively taking steps to utilise solar energy in different ways. But when it comes to farming, setting up solar-powered farms is still a costly affair. Installation costs account for around 8% of the total building cost for a typical rooftop PV plant. A normal 1 KWp plant without any storage facility costs around INR 1 Lakh. The cost of a 100 KWp plant installed by a solar developer, however, can go down to INR 65-70 Lakh. This step will certainly help in reducing the costs further and promoting the usage of solar energy as a vast resource.

As of September 2019, India has 81.33 GW of renewable energy capacity. The target is to achieve an installed capacity of 175 GW by FY’22.

Fixing The Water Issue

Nirmala Sitharaman: Government is proposing comprehensive solutions for 100 water-stressed districts.

Inc42 Take: Currently, a quarter of Indian population is said to be affected by severe drought, which is about 330 Mn people. According to NITI Aayog’s Composite Water Management Index (CWMI) report released in 2018, 21 major Indian cities including Delhi, Bengaluru, Chennai, Hyderabad, and others, are nearing zero groundwater levels by 2020, which will affect access to water for 100 Mn Indians.

The Aspirational India Theme

Nirmala Sitharaman: For the Aspirational India theme, we will begin with focus on agriculture and rural economy. The Indian government is committed to doubling farmer income by 2022. Financial inclusion has boosted farming income. Farmer markets and mandis need to be liberalised, distortion in farms and livestock markets need to be removed.

Inc42 Take: The Electronic National Agriculture Market (eNAM) launched in April 2016 has impacted 9.87 Mn farmers, 109,725 traders till March 2018. 585 markets or mandis in India have been linked while 415 additional mandis will be linked in 2018-19 and 2019-20.

The gross value added by agriculture and allied sector to Indian GDP in FY’19 was $265 Bn, which was a 2% decline in GVA to Indian GDP compared to 2018.

GST Benefit Of INR 1 Lakh Cr Extended To Consumers

Nirmala Sitharaman: GST benefit of INR 1 Lakh cr has been extended to consumers. A new and simplified GST return system coming this April

Inc42 Take: A new and improved GST filing system has been one of the core demand from SMEs. Total GST collection between April to October 2019 was $97.2 Bn (INR 7,01,674 Cr). The GST rollout, with a single stroke, has converted India into a unified market of 1.3 Bn citizens. If implemented well, this can be a game changer for the Indian economy.

India’s Digital Revolution

Inc42 Take: Digital revolution has played a crucial role in the growth of the Indian startup ecosystem. Initiatives like online tax assessment, facial assessments, facial KYCs are adding to the much needed India Stack, essential for the growth of startups.

The last few years of the decade have shown India has a great appetite for technology, data and the internet. In just the last 2 years, mobile data users have nearly tripled to 460 Mn, data prices have reduced by 98%, and data consumption has increased by 11x.

687.62 Mn total internet subscribers in India by end of Q3 2019. Out of which 247.63 Million are rural. As per TRAI estimates.

Riding on this digital revolution, in 2020, India will have over 410 Mn millennial consumers, contributing more than $330 Bn to total consumption expenditure, which is ripe for the taking for startups in the Indian market.

Govt Debt Reduced

Nirmala Sitharaman: The central government debt which has been the bane of our economy. Government debt got reduced in March 2019 to 48.7% of GDP from a level of 52.2% in March 2014.

Nirmala Sitharaman: India has managed to raise 271 Mn people out of poverty between 2006-2016.

GST Collection In Oct 2019 Stood At $97.2 Bn

Budget 2020 Quick Facts: Total GST collection between April to October 2019 was $97.2 Bn (INR 7,01,674 Cr). Domestic GDP (tax on goods and services sold domestically for consumption) had the highest individual contribution 26% ($25 Bn), according to official documents.

Reduced GST Rates Helped Households Save About 4% Of Monthly Spends

Nirmala Sitharaman: An average household now saves about 4% of its monthly spends on account of reduced GST rates. The GST council has been proactive in solving issues. We have added more than 60 Lakh new taxpayers, a total of 40 Cr returns filed. 800 Cr invoices raised, 105 Cr e-way bill generated.

Inc42 Take: Despite being in controversies since its commencement, GST has been one of the milestone developments of the BJP government. Filing GST forms and getting refunds have been tedious since the goods and services tax (GST) was announced on July 1, 2017. Despite hundreds of reforms carried out over the last two years, GST continues to haunt MSMEs and startups. Ease of doing business is yet to improve at the grass-roots levels.

The FM Begins The Union Budget 2020 Presentation

Nirmala Sitharaman: The budget is meant to uplift the sections of the society that need the biggest focus. A budget to boost their [citizen’s] income and enhance their purchasing power.

“Only through higher growth we can achieve that and have youth gainfully and meaningfully employed. Lets have businesses be innovative, healthy and sombient with the use of technology.”

According to the finance minister the three prominent themes of the Budget are:

- Aspirational India: Better standards of living with access to health, education and better jobs for all sections of the society.

- Economic Development for all: “Sabka Saath , Sabka Vikas , Sabka Vishwas”.

- Caring Society: Both humane and compassionate; Antyodaya as an article of faith.

Budget 2020 Guided By Blue Sky Thinking: What Is That?

India’s Economic Survey for 2020 was guided by blue-sky thinking, chief economic advisor Krishnamurthy Subramanian said. The team which wrote the Economic Survey 2018-19 “adopts an unfettered approach in thinking about the appropriate economic model for India. This endeavour is reflected in the sky blue cover of the survey.”

But what is it?

Blue-sky thinking is defined as the activity of trying to find completely new ideas. Considered a step ahead of “thinking outside the box” in corporate-speak, blue sky thinking is said to ignore preconceptions about ground realities and look for alternatives.

Stock Market Update

35 stocks hit one-year lows ahead of Budget 2020 announcement.

FM Sitharaman Ready For Union Budget 2020 With Bahi Khata

Finance minister Nirmala Sitharaman is about to begin her Union Budget 2020 presentation in the next half an hour. Sitharaman has already met President Ram Nath Kovind to present the budget document. Copies of the Budget 2020 have also been brought to the parliament as Sitharaman made an appearance this morning with what has become her personal signature – the bahi khata.

Meanwhile, the Economic Survey 2019-2020 was released on Friday (January 31). According to the survey, India’s GDP growth is expected to be in the range of 6.0 to 6.5% in 2020-21. Citing World Bank data, the survey states that new firm creation has gone up dramatically in India since 2014. While the number of new firms in the formal sector grew at a cumulative annual growth rate (CAGR) of 3.8% from 2006-2014, the growth rate from 2014 to 2018 has been 12.2%.